Maintaining the 2035 target to support the transition of the French automobile industry

With the aim to reduce its CO2 emissions and costly fossil-fuel imports, in 2022 the European Parliament adopted a rule that, from 2035, all new vehicles must be zero-emission, which essentially means that they must be electric. However, this rule is now being questioned, with car manufacturers requesting that it be revised to allow plug-in hybrids or vehicles that run on biofuels, among other changes. Ultimately, if these changes are permitted, this would amount to the continuation of internal combustion engine (ICE) vehicles being sold after 2035.

To justify their requests, the manufacturers are highlighting the crisis that the automobile sector is facing, with declining sales and some factories shutting down. Added to this are the risks of new competition from China, particularly strong in the electric vehicle (EV) segment, as highlighted in a recent parliamentary report (Senat, 2025).

Yet, on closer inspection, the sector’s crisis is less due to the rise of EVs than to manufacturers’ ill-suited strategy of focusing on larger and more expensive ICE vehicles. In a shrinking automobile market, EVs are holding up better than ICE vehicles, especially small French models. Finally, France is well-positioned to produce more EVs, justifying the significant investments made in the sector, from batteries to EV charging infrastructure.

A crisis inherited from the “premium” strategy

Over 25 years, French vehicle production (specifically passenger cars, light commercial vehicles, heavy trucks, buses and coaches) has dropped from 3.3 million to 1.4 million vehicles, leading to factory closures and many job losses (DGE, 2024). This long-standing crisis, which began well before the rise of EVs, is explained by an automobile market that has increasingly focused on “premium” vehicles—more powerful, heavier, larger, and, above all, more expensive. This is a domain where German brands excel, while French brands, specialising in small vehicles, have failed to establish themselves: between 2001 and 2023, Renault, Citroën and Peugeot lost market share, dropping from 25% to 15% of the EU market (Pardi, 2025). Furthermore, to remain competitive in the low-cost small vehicles market, French automobile groups have offshored a large part of their production: in 2023, French car manufacturers produced 23% of their light vehicles in France compared to 53% in 2005 (Banque de France, 2025).

This strategy accelerated after the Covid crisis. Between 2020 and 2024, vehicle prices in France increased by 24% and sales fell by 22%. According to a detailed analysis of prices by segment, researchers from the Institute Mobility in Transition found that half of the price increase is due to manufacturers’ market power, through upselling and pricing power (IMT, 2025). Beyond excluding much of the middle class from the new-car market, this strategy leads to a 22% drop in sales. This trend has intensified in 2025: based on data available to date, the market is expected to reach 1.71 million registrations by year-end, compared to 1.76 million in 2024 and 1.82 million in 2023.

Strong demand for French electric vehicles

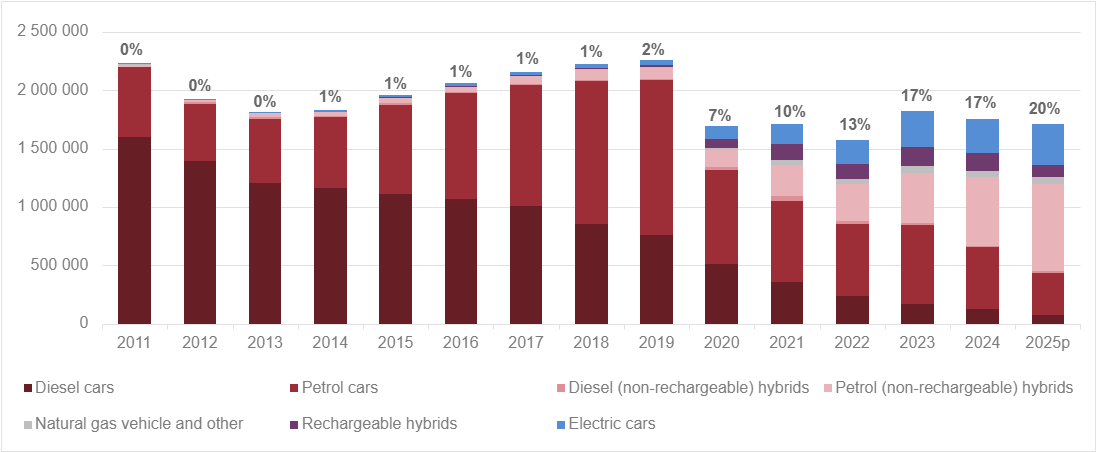

In a declining French automobile market, EVs are holding up well. In 2025, sales of electric cars have already surpassed those of 2024 for the same period. According to data available at the end of September, and factoring in France’s most recent round of its social leasing programme (launched on 30th September),1 electric cars should reach about 20% of the market for new cars in France for the whole of 2025 (see the chart below).

Annual registrations of passenger cars by engine type in France

Note: ‘2025p’ – the data for 2025 are projections only, based on figures as at the end of September 2025. The percentages represent the market shares of electric cars.

Source: SDES, “New light vehicle engines – CO2 emissions and ecological bonus” – September 2025.

Despite the market downturn, electric cars are holding up well because they are becoming increasingly affordable. Their operating cost is much lower than that of ICE vehicles, but their purchase price has long been the main barrier. Nowadays, however, more affordable models are becoming available, such as the Renault 5 e-Tech or the Citroën ë-C3 launched at the end of 2024, both under €25,000. In addition, subsidies, previously in the form of an ecological bonus and now via an energy savings certificate (a “Certificat d’Economie d’Energie”, CEE) premium, help reduce the extra purchase cost compared to an ICE car.

Above all, affordable small models are successful in France. The latest round of the social leasing programme, with EVs available at between €100 and €200 per month, is in high demand among low-income households. In the rest of the market, small electric cars are also popular: the Renault 5, ë-C3 and Peugeot e-208—three city cars at moderate prices—are three of the four best-selling models. Only the Tesla Model Y is an exception, being the only “premium” car in electric cars top sales.

Measures to support the European automobile industry

Currently, about 75% of the value chain of an EV sold in Europe is also located in Europe. While this is a high share, it is lower than that of an ICE vehicle produced in Europe, at 90%. This difference is mainly due to the battery, which is often made in China, with key components also produced there. As things stand, the transition to EVs would expose car manufacturers in Europe to supply risks. This is why support for the restructuring of the sector is being provided at both the French and the EU level, with subsidies from the French government for the creation of battery gigafactories, or the implementation of the “RESourceEU” plan2 to develop the entire supply chain in Europe, including sourcing rare earths.

Competition from Chinese EVs, often cheaper than European ones, is also presented as an obstacle to the automobile sector becoming 100% electric. However, to limit the impact of this competition, which is considered not to be on a level playing field, measures have been put in place, such as taxes on imports of EVs made in China. The application of these taxes has not only limited imports of Chinese vehicles but also encouraged manufacturers to produce in Europe. Financial incentives for buying or leasing EVs also help, with the environmental score in the French eco-bonus3 or the European Commission super-bonus for vehicles whose battery is made in Europe. Thus, in 2024, imports of EVs fell by a quarter, reducing France’s trade deficit in this market segment (Les Échos, 14th August 2025).

Reversing the 2035 zero-emissions target puts investments and activities at risk

With state support, automobile manufacturers and energy providers have joined forces to organise the production of EVs in France, especially battery manufacturing, by creating gigafactories. Building these large-scale plants required significant investment, some of which was state-subsidised. Developing production capacity provides security of supply for the automobile sector and better cost control, but to succeed against cheaper Chinese batteries, these plants need outlets in the national and European markets.

Downstream, in order to overcome what has often been a barrier to EV adoption, vehicle charging infrastructure providers have made significant investments and increased the number of available charging stations. They now need to see their infrastructure being used in order to make their investments profitable.

The transition to EVs is accelerating, due to their advantages in combating climate change and reducing air pollution, their lower operating cost, and their contribution to energy security. Revising the targets would delay the sector’s transformation and put at risk the investments made in the EV production chain in France. Moreover, revising the rule, and including plug-in hybrids or biofuels vehicles, would not provide any immediate outlet for currently unsold ICE vehicles. Maintaining the deadlines while supporting the European electric vehicle sector will help the automobile sector overcome the risks associated with this transition.