Auction revenues in EU ETS Phase 3: a new public resource

By Guillaume Chevaleyre et Nicolas Berghmans, I4CE

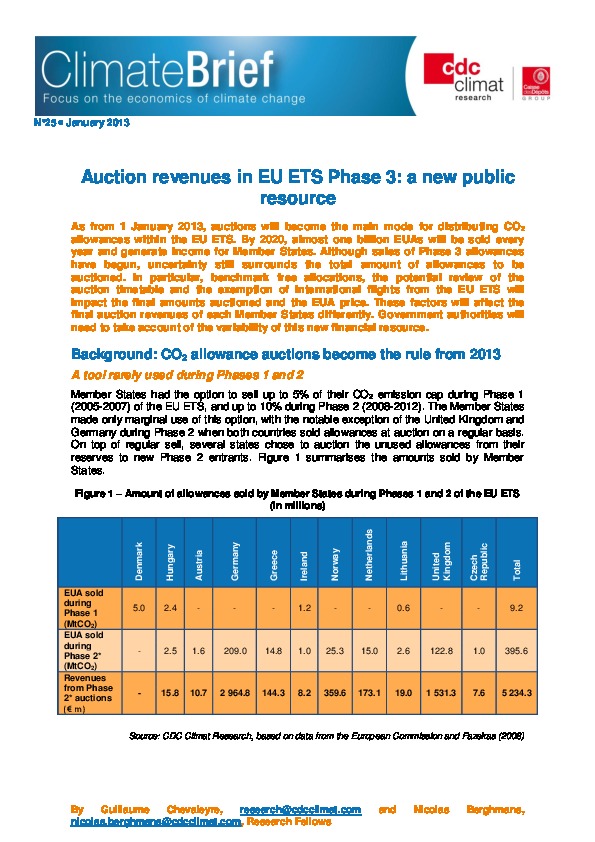

As from 1 January 2013, auctions will become the main mode for distributing CO2 allowances within the EU ETS. By 2020, almost one billion EUAs will be sold every year and generate income for Member States. Although sales of Phase 3 allowances have begun, uncertainty still surrounds the total amount of allowances to be auctioned. In particular, benchmark free allocations, the potential review of the auction timetable and the exemption of international flights from the EU ETS will impact the final amounts auctioned and the EUA price. These factors will affect the final auction revenues of each Member States differently. Government authorities will need to take account of the variability of this new financial resource.