How can financial intermediation better contribute to the climate transition?

Financial intermediation, understood as the indirect financing of beneficiaries through on-lending, equity investments, debt security, or guarantees to local financial institutions, has gained significant momentum over recent years. It is increasingly seen as a promising avenue to mobilise finance at scale, using concessional finance to leverage additional investments through financial intermediaries (FIs). Access to concessional finance can strongly motivate FIs to engage in climate-related investments, especially when they otherwise face financial constraints. With this additional finance, FIs can in turn fund local beneficiaries, including local financial institutions, through smaller size financial products. Financial intermediation is also considered to be an opportunity to build capacity among FIs to invest in line with the Paris Agreement’s objectives. Yet, although it has the potential to drive climate-positive transformation of local markets, financial intermediation has several limitations related to transparency on use of funds and misallocation of funds, potentially perpetuating existing inequalities between financial actors, among others. As new methodologies are being developed to ensure Paris alignment of intermediated finance, and with the focus on impact in the real economy increasing, it is critical to ensure that evolving practices are consistent with one another, and deliver results that support local financial systems’ and national economies’ long-term transformation towards the achievement of the Paris Agreement’s objectives.

This report aims to support better use of financial intermediation by public development banks (PDBs) providing international development finance, helping PDBs work better together as a system, with a common understanding of where they contribute the most to low-emissions and climate-resilient development. It mainly focuses on financial intermediation through on-lending to public (government-owned) financial institutions in developing countries (on-lending being more commonly used by MDBs and international PDBs with their financial intermediaries, compared to other financial instruments). It provides insights on the links between PDBs providing international development finance’s practices and their financial intermediaries’ alignment with the Paris Agreement, and highlights how PDBs can better engage with their financial intermediaries for impact. Compared to previous research in this area, it further brings in the perspective of financial intermediaries, and focuses on how better engagement can translate into climate and development outcomes.

Throughout this report, use of the acronym PDBs refers to MDBs, bilateral development banks, as well as development finance institutions (DFIs). In this research, a financial intermediary (FI) mostly refers to a regional or national development bank (NDB) or a local public financial institution (e.g. mortgage or housing finance provider), in a developing country, that channels international development finance to local beneficiaries.

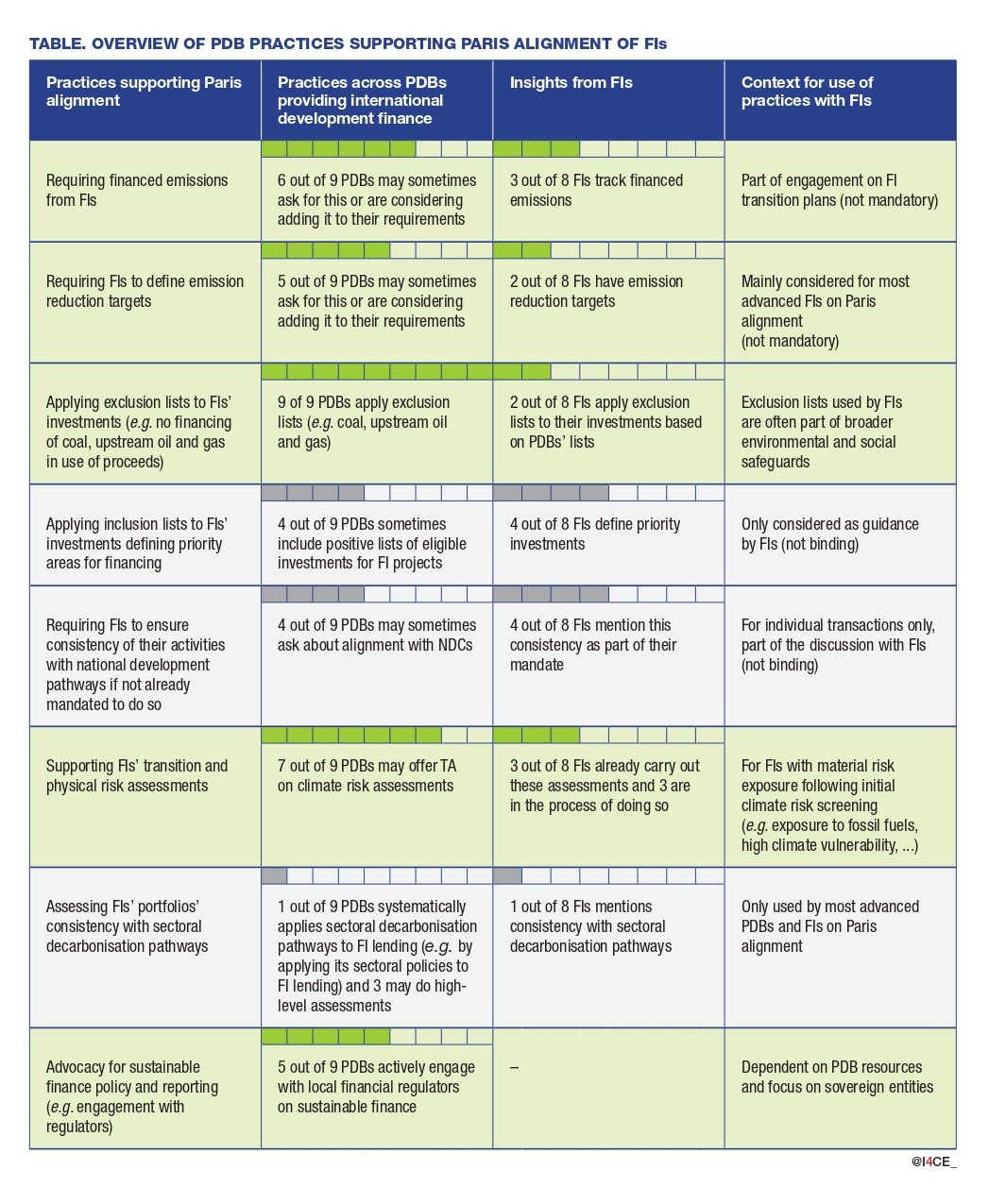

The Table below provides an overview of current practices across PDBs providing international development finance in their requirements to FIs, and how they are mirrored in FIs’ practices. The selected practices discussed in interviews with representatives of PDBs and FIs build on relevant practices towards Paris alignment for PDBs. Most common practices, i.e. applied by more than half of the PDBs considered, are highlighted in green.

The following recommendations apply to PDBs providing international development finance, in order to tailor their approaches to Paris alignment of financial intermediation, drawing on their collective experience with financial intermediaries:

Outside of a specific FI transaction:

- PDBs should evaluate whether national development pathways are adequately defined in nationally determined contributions (NDCs) or national planning documents and assist in the development of these pathways where needed, in addition to requiring FIs to align with these pathways. This alignment can also be supported by engaging with national regulators to adjust local financial institutions’ mandates to these pathways, and by ensuring NDCs target these institutions’ role in the achievement of climate targets in the country.

- PDBs should continue to support, both technically and financially, the development of regulatory environments and reporting requirements that enable and strengthen financial flows towards climate and development outcomes. National and international regulatory requirements as well as requirements from investors are a major driver of change for FIs.

When arranging on-lending with FIs (prior to approving transactions):

- Fossil fuel exclusion lists are difficult to implement in contexts where the economy is fossil fuel-dependent, and PDBs should continue to support deep decarbonisation in these contexts, parallel to their engagement with FIs. On the other hand, exclusion lists linked to environmental and social (E&S) safeguards still have room for improvement (g. in their scope of application) and can deliver further climate benefits when combined with Paris alignment considerations. Monitoring exclusion list application by FIs during execution is important, particularly for those with higher risk and lower capacity.

- PDBs should consider using green inclusion lists as they prove to be a good starting point in order to promote climate-smart objectives, and can be integrated into existing strategic objectives and help prioritise FI investments towards Paris-aligned activities.

- PDBs need to systematically consider how engagement with FIs can support improvement in their practices (g. through results-based financing, dialogue on Paris alignment and priority areas for investment and institution-level transition, application of E&S safeguards …) and further influence FIs’ practices, prior to disbursement as well as throughout the relationship with the FI;

- PDBs need to adjust the abovementioned requirements to FIs’ level of advancement on climate, and the financial instruments used to the local context (g. disclosure requirements already in place, level of transition risk i.e. exposure to fossil fuels, limited opportunities for climate finance in market, vulnerability to physical risks, …), while relying on publicly disclosed assumptions that reflect local needs, and scenarios that reflect the country’s pathway towards decarbonisation and resilience.

Throughout the on-lending period:

- Technical assistance is key to supporting the implementation of all the abovementioned practices in many cases. For example, physical and transition risk assessment is often taken up after initial support or technical assistance from PDBs providing international development finance. Technical assistance to navigate sustainability reporting requirements and support financed emissions tracking where relevant could also play an important role in building capacity on climate performance self-assessment. It can help address data availability issues, which are an important limitation to emissions tracking. Tracking financed emissions is not yet within reach for most FIs interviewed in this study.

- Setting emission reduction targets (at project or portfolio level) requires FIs to track financed emissions, and also requires significant internal buy-in. As such, it is a practice for more advanced FIs on climate, and should be considered carefully to ensure it is in line with the FIs’ development mandate, for instance. It can also be replaced with or complemented by the tracking of other metrics that reflect improvement in Paris alignment and that can reflect the increase in climate-related activities and investments and/or decrease in activities with adverse climate impacts.

- In addition to targeted technical assistance to FIs, which most FIs considered in this research benefitted from, PDBs should help build capacity of FIs by supporting knowledge-sharing on institutional climate mainstreaming or regional challenges to the transition, through communities of practice and networks of financial institutions facing similar issues (g. regional networks and alliances of PDBs & DFIs (ALIDE, EDFI, etc.), FICS, IDFC, Mainstreaming Climate in Financial Institutions, etc.).