Will anybody dare resuscitating the EU ETS?

By Stefan Schleicher – Professeur au Wegener Center for Climate and Global Change at the University of Graz

![]() EU ETS – MSR timetable: The first trilogue meeting between EU institutions took place on 30th March. The second is scheduled on 5th May. The Committee of Permanent Representatives of the Member States approved an implementation of the MSR in 2021.

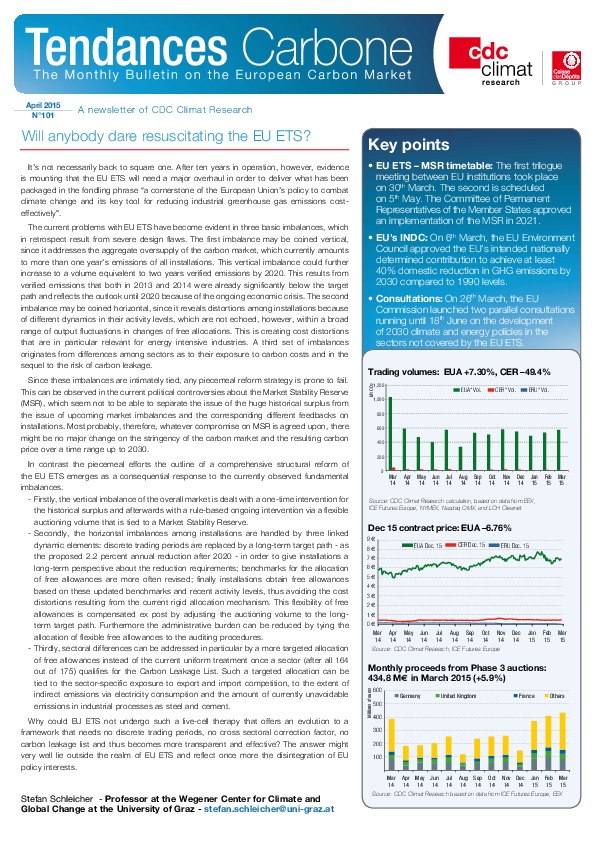

EU ETS – MSR timetable: The first trilogue meeting between EU institutions took place on 30th March. The second is scheduled on 5th May. The Committee of Permanent Representatives of the Member States approved an implementation of the MSR in 2021.

![]() EU’s INDC: On 6th March, the EU Environment Council approved the EU’s intended nationally determined contribution to achieve at least 40% domestic reduction in GHG emissions by 2030 compared to 1990 levels.

EU’s INDC: On 6th March, the EU Environment Council approved the EU’s intended nationally determined contribution to achieve at least 40% domestic reduction in GHG emissions by 2030 compared to 1990 levels.

![]() Consultations: On 26th March, the EU Commission launched two parallel consultations running until 18th June on the development of 2030 climate and energy policies in the sectors not covered by the EU ETS.

Consultations: On 26th March, the EU Commission launched two parallel consultations running until 18th June on the development of 2030 climate and energy policies in the sectors not covered by the EU ETS.