The adaptation reflex in public investment in practice: Pathway for 2025 and prospects

Report only available in French

The 3rd French national climate change adaptation plan (PNACC3) seeks to generalize an “adaptation reflex” in all public investments and all public support for investment. Operationalizing this ambition is essential for:

- Stop investing in infrastructure, buildings and equipment that will not be ready to cope with the consequences of climate change;

- Seize the best opportunities available by taking advantage of investments already planned to strengthen the level of adaptation of the French economy at lower cost.

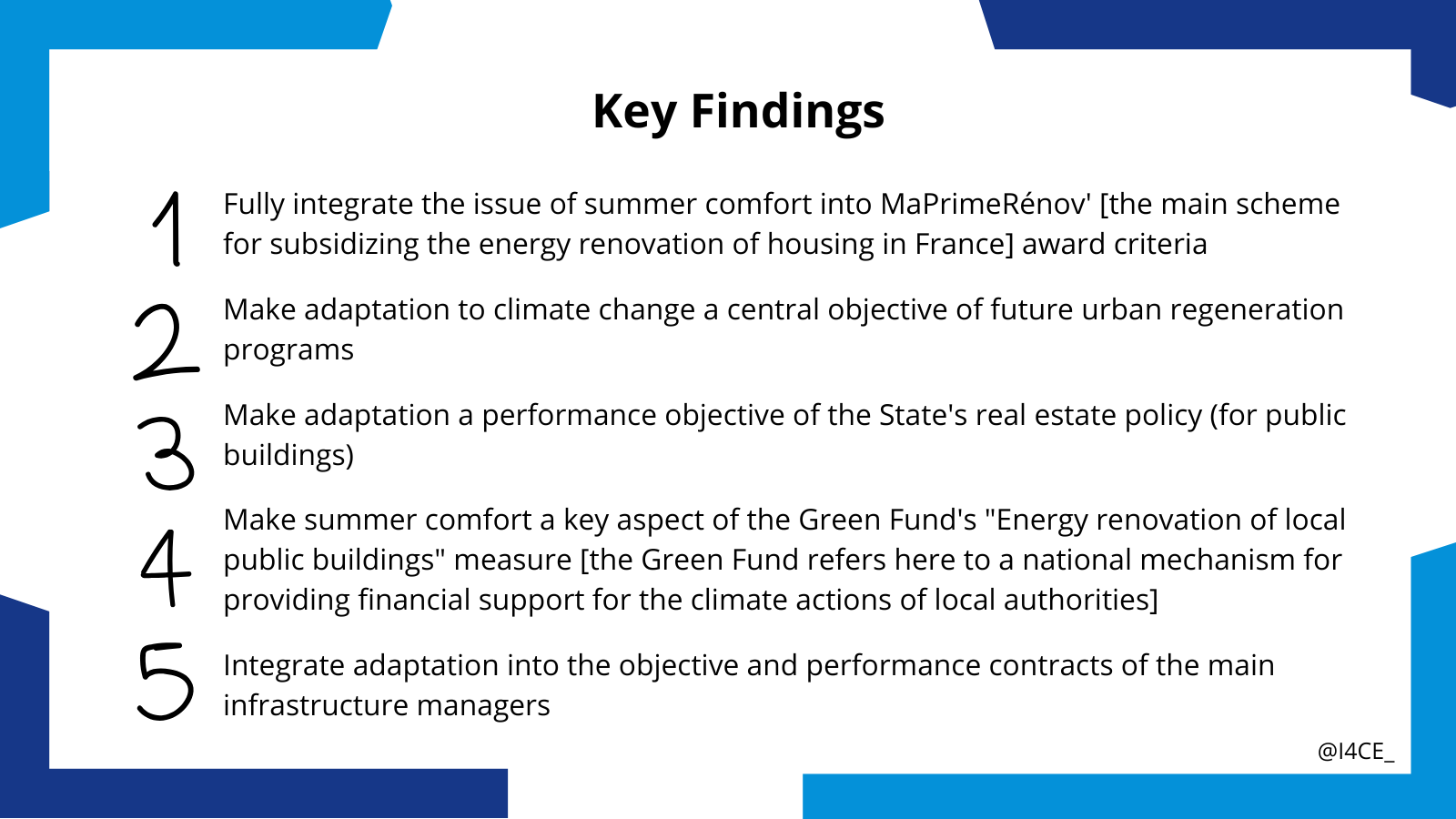

To move in this direction, we have identified 5 initial areas – together involving up to 25 billion euros of existing annual investment – in which action can be taken as early as 2025 by activating the following levers:

For major infrastructure, architectural or industrial projects already launched, conducting stress tests them in the light of +4°C would make it possible to reconsider decisions already made by identifying the most critical ones to adapt before the choices of location or design become irreversible.

To take this a step further, four generic methods can be considered, depending on the field and type of investment, in order to progressively generalize this scheme for taking adaptation into account to all investments affected by the impacts of climate change:

- Taking adaptation into account right from the design stage of future programs;

- Adapting norms and standards ;

- Deploying a “tracc-proofing” approach (verification of compatibility with the national reference warming trajectory) on a case-by-case basis for major projects;

- Contractualizing investments on the basis of adaptation strategies: asset management strategies, regional or sector strategies.

Whatever the approach to operationalization, it will be essential to establish a form of accountability for the implementation of the “adaptation reflex”. This must involve not only the administration, but also Parliament, independent audit bodies such as the Cour des Comptes, and civil society.