German nuclear phase-out: Implications for the EU ETS

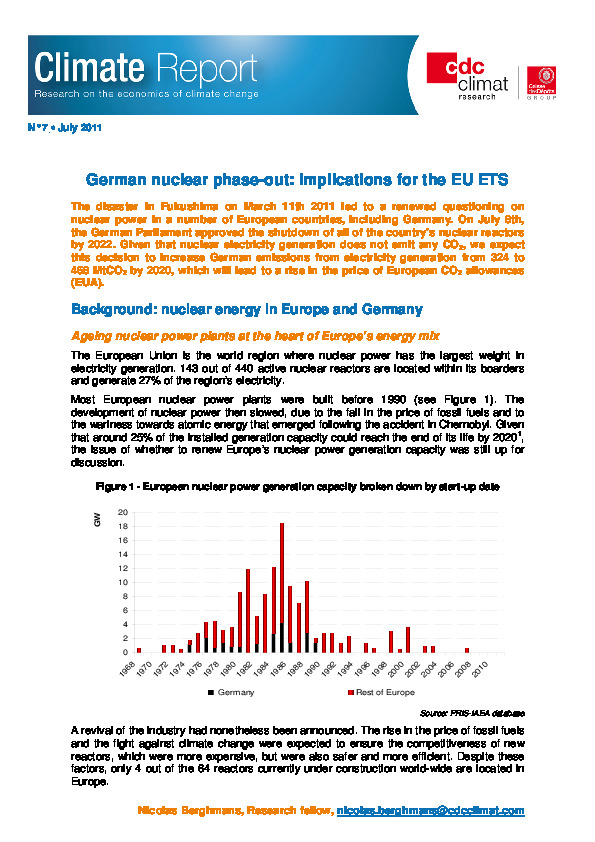

The disaster in Fukushima on March 11th 2011 led to a renewed questioning on nuclear power in a number of European countries, including Germany. On July 8th, the German Parliament approved the shutdown of all of the country’s nuclear reactors by 2022. Given that nuclear electricity generation does not emit any CO2, we expect this decision to increase German emissions from electricity generation from 324 to 468 MtCO2 by 2020, which will lead to a rise in the price of European CO2 allowances (EUA).