State of EU progress to climate neutrality – 2025 Flagship report

Key results of the 2025 Flagship Report:

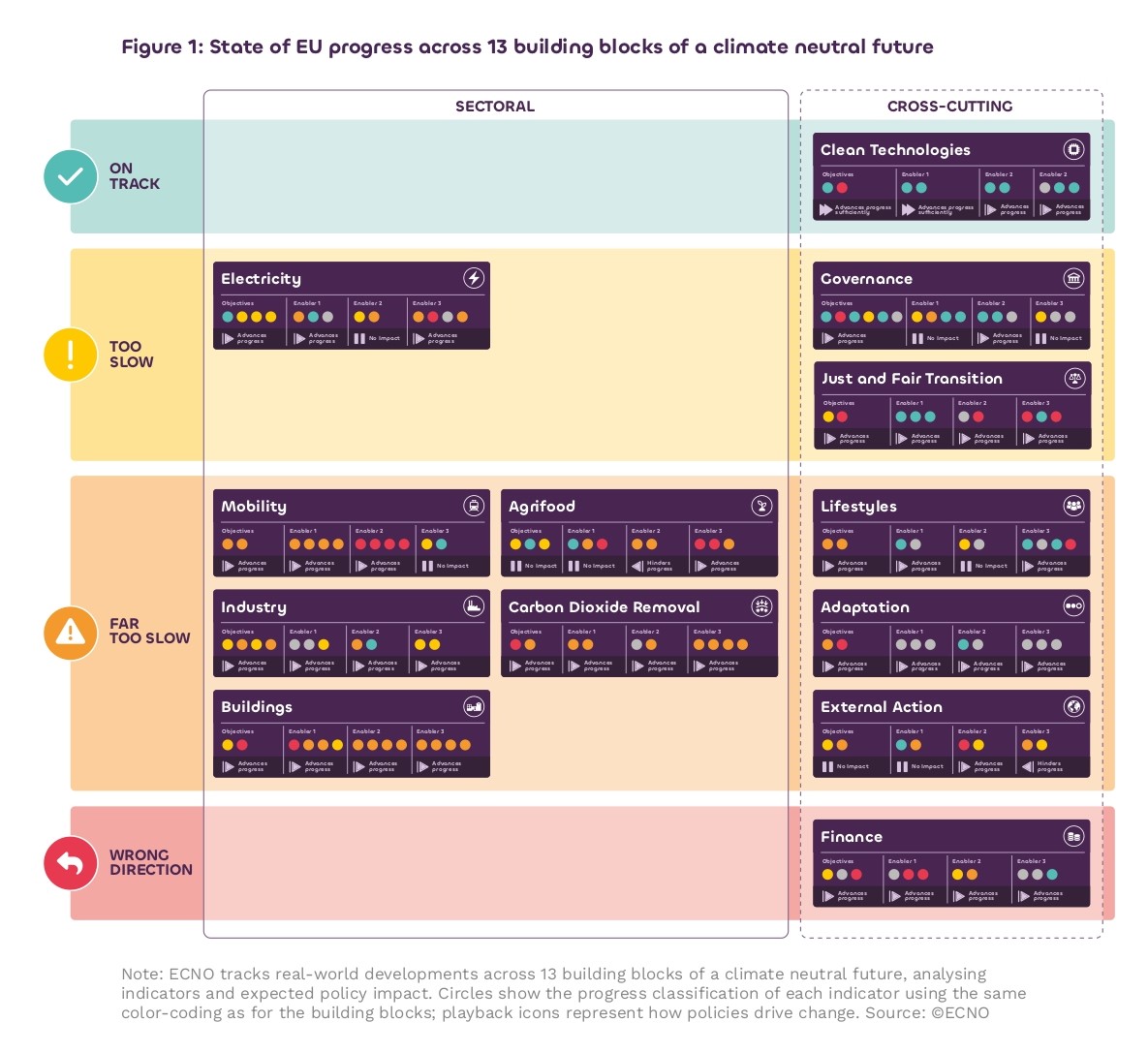

ECNO’s analysis is structured around 13 building blocks of the transition, tracking changes in the six-year trend for nearly 150 indicators and also the expected impact of policies – a new addition to this year’s report. In the 2025 edition, we also analysed the changes through the lens of broader EU objectives, namely competitiveness, resilience, and citizens’ well-being. The EU has initiated an economy-wide transition to climate neutrality by 2050. While many important on-the-ground developments have accelerated compared to last year’s assessment, the current pace of the transition is still not fast enough. Investments are lagging, underscoring the need for targeted policy adjustments to provide certainty for businesses and citizens alike. Speeding up the shift to a clean economy is also fundamental to Europe’s long-term competitiveness and security. Deepening geopolitical tensions present a challenging backdrop for this endeavour but also strengthen the case for more decisive action.

The European Commission has tabled the Clean Industrial Deal in response to these challenges, integrating policy priorities around competitiveness and decarbonisation. Together with the shaping of the EU’s next long-term budget (2028-2034), it provides a specific window of opportunity to align EU policy with long-term priorities.

This report highlights where the EU is on track and where additional efforts are needed to create the enabling conditions for a prosperous, climate neutral future. Our policy recommendations are based on detailed, data-driven insights into real-world developments across the economy.

Visible momentum: Cleantech progress supports industrial competitiveness and employment

The 2025 results show positive momentum in several policy areas. Notably, there are signs that the EU’s cleantech industrial base and innovation ecosystem are improving – now rated on track. Value added in the cleantech industry is on the rise and manufacturing capacities are increasing for key technologies, such as wind, solar photovoltaics, heat pumps, electrolysers, and batteries. Battery manufacturing is on track to exceed the EU target of 550 GWh annually by 2030.

Solar power expansion continued to exceed expectations, with a record 65 GW of new capacity installed in 2024. For the first time in mid-2025, solar became the single largest source of electricity in the EU.

The industrial sector saw improvements across all indicators compared to last year, especially on energy efficiency, resource productivity and circularity, and the use of renewables. These positive developments have boosted jobs in renewable and environment-related sectors, while employment has also been rising in the EU’s coal and heavy industry regions.

A rebound in carbon storage in forests as well as a growing market for the future delivery of technical removals contributed to an improvement in the assessment of Carbon Dioxide Removal – moving from wrong direction to far too slow in this year’s report.

Across most of the building blocks that ECNO assesses, existing EU policies are expected to accelerate progress on the ground.

Challenges identified: Finance for the transition remains a major stumbling block and contributes to reduced progress in other areas

While the transition is picking up pace, our analysis highlights sectors and policy areas facing hurdles and recommends actions that policy-makers can take to overcome them.

Financing gaps and misaligned incentives continue to hinder investment in industrial decarbonisation and slow down broader demand for clean technologies.

In 2023, there was a climate investment gap of EUR 344 billion, manifesting particularly in a slow pace of building renovations, a decline in heat pump uptake, a slump in EV sales, and an insufficient expansion of wind power. As a consequence, electrification has developed too slowly across all energy demand sectors. This poses a risk to the continued build-up of cleantech manufacturing, which has been improving, but at a pace that is already plateauing. These developments put the EU’s industrial competitiveness under pressure. Underlying causes are reflected in six-year trends showing that fossil fuel subsidies and investments in fossil fuel supply have increased, while financial support for renewables has declined. Businesses face challenges like slow permitting times, missing or inadequate infrastructure, and access to skilled workers.

What is needed to close the climate investment gap and improve industrial competitiveness?

- Create a supportive investment framework for clean goods, technologies, and decarbonisation efforts

→ align public budgets, taxation, and pricing mechanisms to support the climate transition

- Remove bottlenecks to the transition

→ speed-up permitting, align planning and investment into grid development with climate targets, and advance skill-building efforts

- Increase demand for clean goods and technologies and support the creation of lead markets

→ make public procurement more sustainable and focused on EU products, maintain existing standards, and focus public support

- Advance implementation of EU legislation in Member States

→ adjust national incentives including phasing out fossil fuel subsidies to support electrification, renewable expansion, infrastructure and cleantech uptake

Despite efforts to build resilience, the EU economy remains vulnerable to internal and external shocks, ranging from climate change to geopolitical tensions and supply chain dependencies.

Across Europe, climate impacts increasingly threaten livelihoods and the economic systems that support them causing over EUR 160 billion in economic losses between 2021 and 2023. Energy dependency is another source of vulnerability, as demonstrated by the energy crisis following Russia’s invasion of Ukraine. In 2024 alone, the EU imported close to EUR 400 billion worth of fossil fuels, equal to 2% of the bloc’s GDP. This reinforces the EU’s dependence on fossil fuel exporters and leaves it vulnerable to global oil and gas market volatilities. In addition, China’s dominance in manufacturing, raw materials, and technology raises issues for EU supply chain resilience.

What is needed to improve the EU’s resilience (beyond closing the climate investment gap, reducing fossil fuel dependency and improving competitiveness)?

- Strengthen climate considerations in EU foreign policy

→ promote global cooperation and resilient clean trade partnerships

- Strengthen climate resilience through data-informed adaptation action

→ invest in and mandate adaptation measures and improved data on actions and financing

Citizens have much to gain from a climate neutral transition, but national and regional disparities persist.

While overall employment has increased, the competitiveness of the EU’s coal and heavy industry regions saw declines over the past six years and an increasing number of people see themselves as energy-poor, reaching 11% of the EU population in 2023. Despite rising concerns over the cost of living, more than 80% of EU citizens support the overarching aims of the transition and have begun to reap the benefits it brings – from job creation to improved environmental quality, and more secure and affordable energy. Citizens also express a desire to play a more active role in the transition, yet national citizens’ climate assemblies have been implemented one-off in only eight countries since 2019, reflecting weak overall frameworks for public participation. Moreover, access to sustainable lifestyles and consumption choices is often limited by inadequate infrastructure and incentives.

EU agricultural policy has not yet caught up with consumer trends, missing an opportunity to support more resilient and sustainable livelihoods for farmers.

Europeans are diversifying what they eat in favour of healthier, more sustainable diets. In 2023, beef consumption fell below 10 kilograms per person, after years of steady decline. At the same time, the EU’s Common Agricultural Policy continues to support emissions-intensive farming models, with 80% of current subsidies flowing to animal-based production. The EU also wastes as much food as it imports, with an equivalent of around EUR 130 billion worth of food thrown away each year.

What is needed for a fair transition and resilient agricultural system?

- Empowering action and engagement by citizens, and relief for vulnerable groups

→ ensure the continuation of EU-level just and inclusive transition funding and facilitating sustainable consumer choices

- Reorient the agrifood system to benefit both farmers and the planet

→ redirect CAP subsidies to support plant-based production and agroecological practices, strengthen food waste reduction targets, and implement clearer date labelling

Figure 2: How qualitative data translates to actionable policy areas

Outlook: transition monitoring for competitiveness and decarbonisation

This analysis underscores the value of tracking enabling conditions for a clean, fair, and competitive transition. While the EU monitors progress in several policy areas, it lacks a unified system for tracking progress on the common enabling conditions of its two interlinked priorities of competitiveness and decarbonisation. Parallel systems risk siloed, uncoordinated policy-making. With limited time and resources, the EU needs the best available information to ensure it meets its objectives. As part of implementing the Clean Industrial Deal, a common EU framework integrating competitiveness and climate priorities should be established. This could deliver a transparent, comparable evidence base to identify obstacles and guide policy at EU and Member State levels.

The European Climate Neutrality Observatory is an independent, consortium-based entity, initiated and supported by the European Climate Foundation.