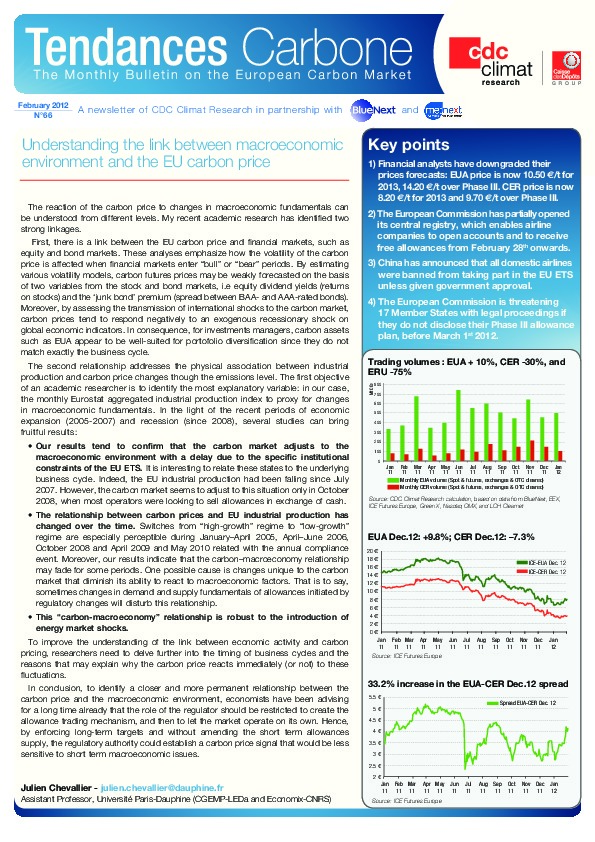

Understanding the link between macroeconomic environment and the EU carbon price

By Julien Chevallier

The reaction of the carbon price to changes in macroeconomic fundamentals can be understood from different levels. My recent academic research has identified two strong linkages.

First, there is a link between the EU carbon price and financial markets, such as equity and bond markets. These analyses emphasize how the volatility of the carbon price is affected when financial markets enter “bull” or “bear” periods. By estimating various volatility models, carbon futures prices may be weakly forecasted on the basis of two variables from the stock and bond markets, i.e equity dividend yields (returns on stocks) and the ‘junk bond’ premium (spread between BAA- and AAA-rated bonds). Moreover, by assessing the transmission of international shocks to the carbon market, carbon prices tend to respond negatively to an exogenous recessionary shock on global economic indicators. In consequence, for investments managers, carbon assets such as EUA appear to be well-suited for portofolio diversification since they do not match exactly the business cycle.