The unlocked potential of carbon revenues to help fill the climate finance gap

Climate negotiations are taking place next week in Bonn, with finance once again high on the agenda.

COP 29 ended last year with a New Collective Quantified Goal (NCQG) –revised climate finance target to replace the USD 100 billion goal. The NCQG decision put forward a commitment by developed countries to lead in providing USD 300 billion per year by 2035 for developing countries, as well as a proposal to work on a roadmap to scale up climate finance for developing countries to reach a level closer to the estimated needs –the ‘Baku to Belem Roadmap to 1.3T’ (USD 1.3 trillion). The latter must be delivered at the end of the year at COP 30, and strong efforts are being put in the task by the Brazilian Presidency.

Yet the current global economic and geopolitical context has led to an increasingly complex landscape for international climate and development finance. Cuts in Official Development Aid (ODA) and climate finance have spread since the new Trump administration took office in the United States, as part of a part of a broader rollback of climate and development aid policies. In Europe, a growing focus on competitiveness and security, combined with fiscal constraints in several countries, is already having an impact on EU climate investments. While emerging and developing countries are confronted with increasingly limited fiscal space and debt burden that hinder their ability to invest on climate and development goals.

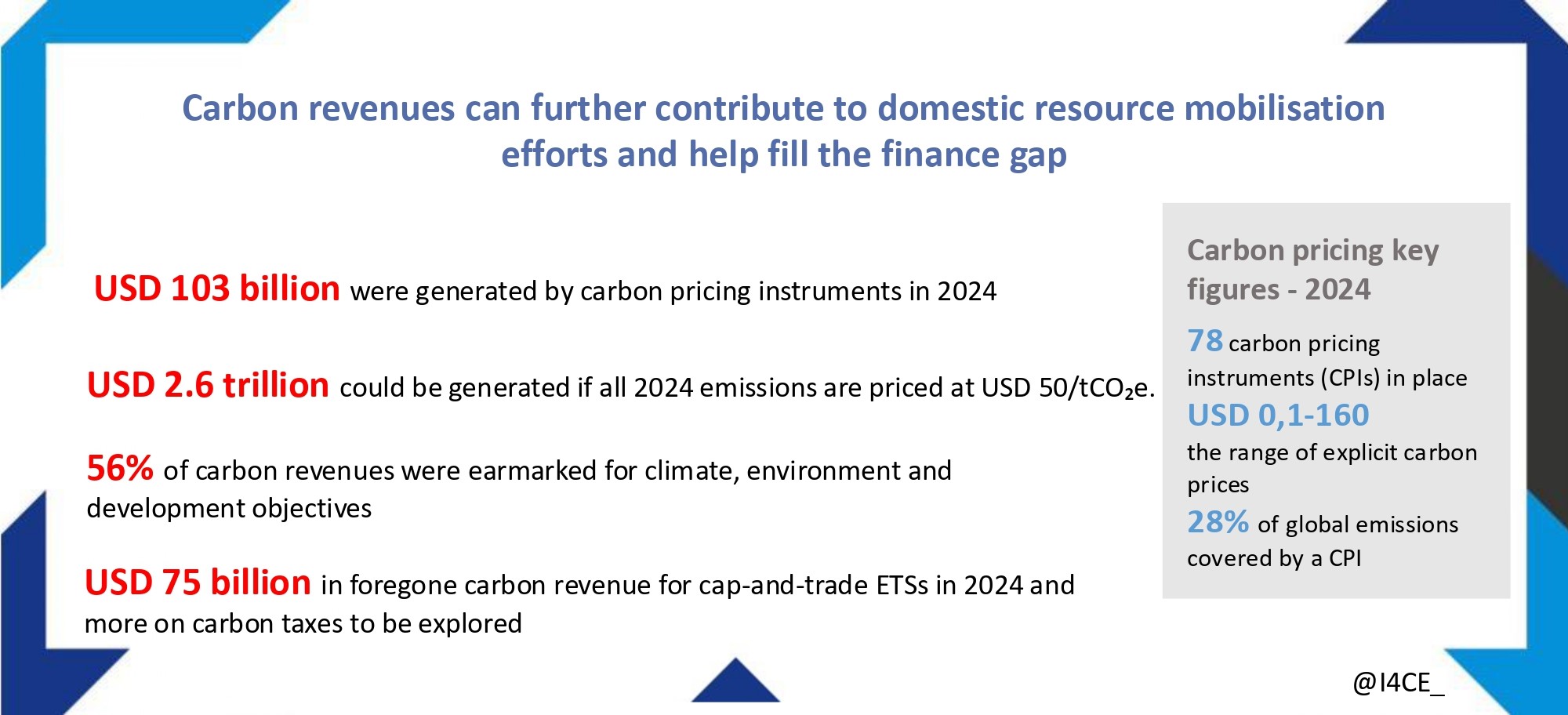

In this challenging landscape, exploring diverse policy tools to mobilize and align financial flows is more crucial than ever. Carbon pricing instruments and their revenues are part of the tools available that can help with this task. The 2025 edition of the Global Carbon Accounts, launched this week in the context of the Innovate4Climate 2025 in Sevilla, provides insights into both current and untapped potential for carbon pricing revenues to support a range of policy goals. USD 103 billion in revenues collected in 2024, 56% of revenues used for environment and development objectives, and at least USD 75 billion in revenue forgone… These are some of the key figures you will discover when reading the new edition of I4CE‘s Global Carbon Accounts.