Supporting financial institutions in developing countries in their alignment journey with climate goals

How IFIs can start moving from a project, to a counterparty and system level approach

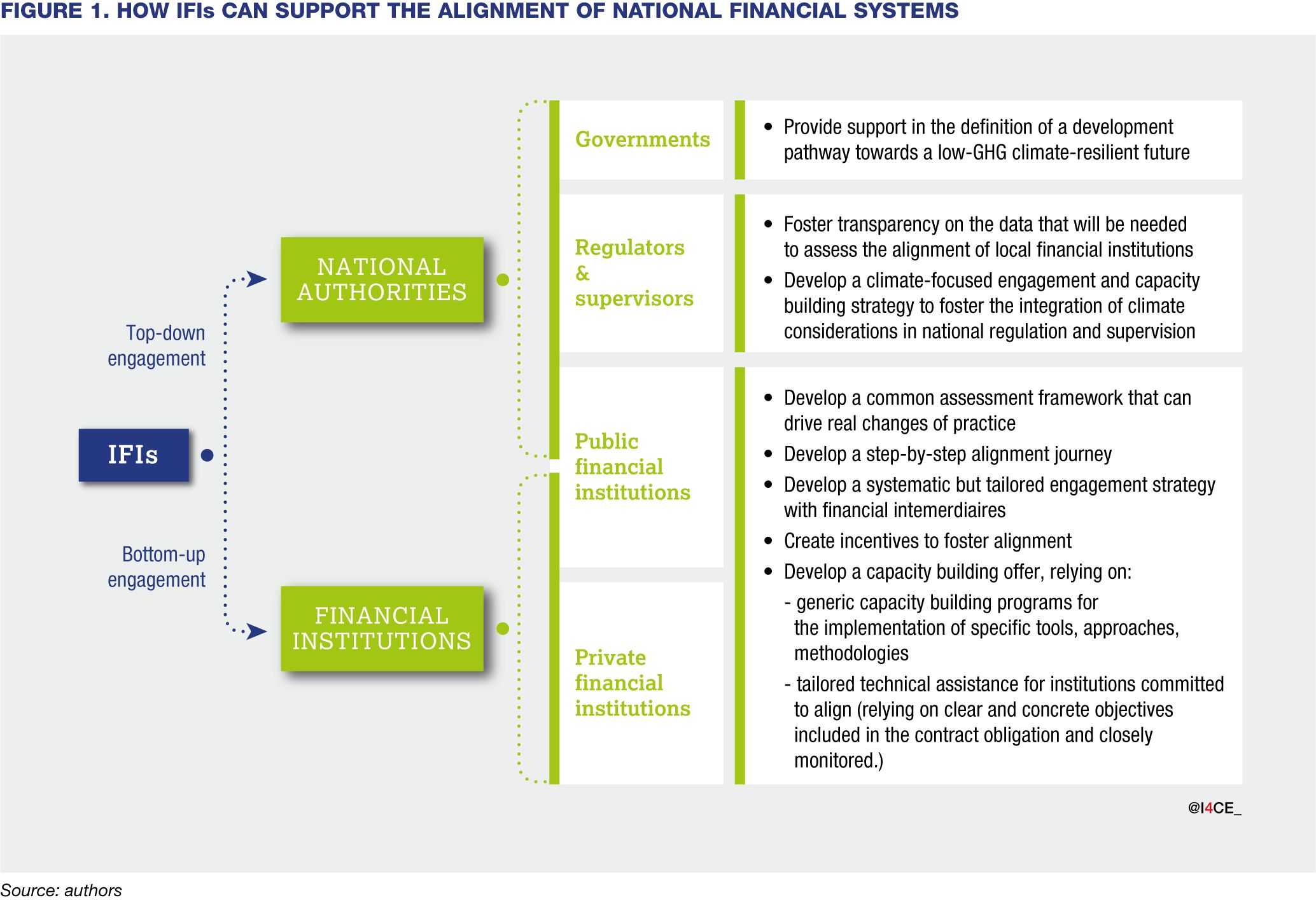

This report builds on previous work developed by the consortium of think tanks gathering Germanwatch, NewClimate Institute and the World Resources Institute, namely ‘Aligning financial intermediary investments with the Paris agreement’. Written in partnership with NewClimate Institute, this report provides practical guidance for International Financial Institutions (IFIs) to support financial institutions’ alignment with the Paris Agreement goals, and contribute to transforming local financial systems. This guidance is developed around three pillars:

- developing a harmonised alignment assessment;

- supporting the alignment of financial intermediaries;

- at the national level, supporting the alignment of financial systems.

Developing a harmonised alignment assessment

There are a few IFIs that have developed approaches for assessing their financial intermediaries’ alignment. These approaches however require different data and therefore necessitate different practices from financial intermediaries. Moving forward, it will be key for IFIs to agree on a harmonised alignment assessment framework that will not only be used for their own assessment purposes but can drive real changes of practice.

Based on a review of existing assessment frameworks and interviews with IFIs and experts from civil society organisations, authors suggest structuring this alignment assessment around:

- a quantitative assessment of current operations;

- a qualitative assessment of internal processes; and

- a qualitative assessment of the forward-looking alignment strategy.

IFIs have the expertise to provide guidance on how to align internal processes with the Paris Agreement objectives over time. To develop comprehensive guidance, IFIs should rely on existing and upcoming international standards such as recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) or guidance on transition plans as well as guiding frameworks from voluntary initiatives on climate mainstreaming. Authors of the report suggest, on that basis, a principle-based step-by-step alignment journey for financial intermediaries.

Click here to see the step-by-step alignement journey

Supporting the alignment of financial intermediaries

Introducing new alignment criteria will require IFIs to develop an engagement strategy with their financial intermediaries on climate change and alignment. The report suggests the following guiding principles for IFIs’ engagement strategies:

- `make the case’ of Paris alignment for both development banks and commercial financial institutions;

- ‘lead by example’ and build on their own experience to create a peer-to-peer engagement process on Paris alignment;

- start progressively but systematically;

- develop a pragmatic dialogue on how to align driven by clear actions presented in a harmonised step-by-step journey;

- develop a concrete dialogue on what to align driven by the opportunities of the transition to low-GHG climate-resilient economies for the financial intermediary;

- tailor this engagement process, taking into consideration:

- the countries and sectors in which financial intermediaries are operating,

- the level of alignment of their financial intermediaries and willingness to align,

- the influence financial intermediaries may have on the transition,

- the influence IFIs may have on their financial intermediary.

In addition, IFIs are uniquely equipped to build the capacity of financial intermediaries and help accelerate their alignment journey. Experts from IFIs, financial intermediaries, and CSOs all agree that tailored technical assistance can have major impact on the transformation of internal practice. Based on lessons learned from existing technical assistance on climate change, interviewed professionals from IFIs and financial intermediaries recommend this technical assistance to be:

- offered to institutions who have publicly demonstrated their commitment to advance on the institutional integration of climate considerations at the strategic and operational levels;

- tailored to the institution’s needs and developed in line with the institution’s climate strategy, objectives, and targets;

- relying on clear and concrete objectives which present how the institution aims to get to the next alignment stage. This should be included in the contract obligation and closely monitored.

Supporting the alignment of financial systems at the national level

While providing support to individual financial institutions in their alignment journey is key, voluntary approaches will not be sufficient to align financial systems in developing countries. To ensure impact at scale, these efforts should be complemented by a climate-focused engagement and capacity building strategy to foster the integration of climate considerations into national regulation and supervision. This engagement strategy would contribute to creating an enabling environment, and could be articulated in policy-based loans, including a technical assistance offer to provide support for the following:

- strengthening the climate information infrastructure;

- setting supervisory expectations and monitoring their implementation;

- increasing financial institutions’ awareness on climate risks (signalling, supervisory engagement, research) and identifying and assessing climate-related risks (including by running stress tests);

- requiring transition plans and integrating them into the supervisory process.

Providing support to both individual financial institutions as well as partner country regulators and governments should be as coherent as possible, ideally along the lines of a joint IFI bottom-up and top-down approach. Considering current constraints, it is important that IFIs initiate work on how to best complement each other and prioritise efforts where they have the most added value. Moving forward, IFIs will need the resources and mandate to engage in these different areas of work at scale.

These efforts are in line with current expert recommendations on the reform of the global financial architecture, which highlighted the importance of strengthening domestic public finance and capital markets that are likely to play an important role in meeting sustainable development financing needs (Songwe, Stern, and Bhattacharya 2022). Capacity is often the main barrier for a green financial sector reform in developing countries and IFIs have a number of tools (policy-based loans, technical assistance, etc.) and resources (internal expertise, research and knowledge products, tools and methodologies, etc.) to build this capacity . The support for the alignment of local financial systems should be more explicitly discussed in current debates on the reform of multilateral development banks and how they may increase the impact of their activities.

Why is the international financial architecture being reformed? What are the challenges of development finance today? How should they be addressed? In two minutes, Alice Pauthier from I4CE answers these questions and talks about Development finance.

Co-written with