The economic implications of the transition to a low-carbon and resilient economy: an LTS dashboard for Finance Ministers

A dashboard for Finance Ministers to support the implementation of long-term strategies

Long term national climate strategies, such as Long-Term Strategies (LTS) published to the UNFCCC, are key documents developed by governments to envision the transition to a low-carbon and climate resilient economy at the 2050 (or later) time-horizon. As of the beginning of COP 27 in Sharm-el-Sheikh, Egypt, on November 2022, 55 countries had submitted an LTS to the UNFCCC, answering renewed calls for countries to develop such strategies at COP 26. It is expected that additional LTS will be published shortly.

The implementation of LTS and other national long term climate strategies generally poses challenges to governments, including conducting large-scale yet targeted actions over multiple time horizons. A first step to circumvent these challenges would be for Finance Ministries to develop financing strategies for LTS. In doing so, they would ensure that necessary climate investments are unlocked, that enough public funding is safeguarded to support effective climate action, and that the positive or negative macroeconomic implications of the transition are anticipated and managed. In this report, I4CE comes back on LTS implementation challenges and on the development of financing strategies as solution.

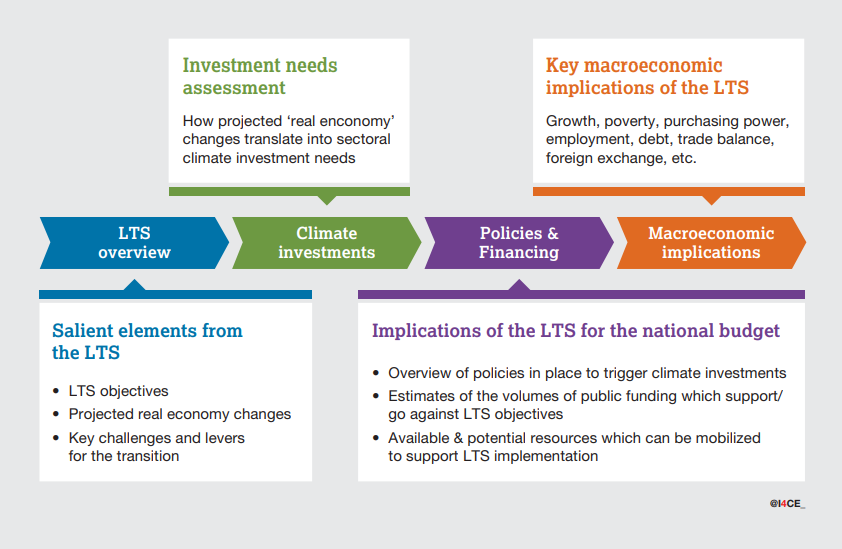

To support Finance Ministries in this endeavour, I4CE and the 2050 Pathways Platform have developed a dashboard template containing economic indicators to assess, act on, and monitor the economic implications and opportunities ensuing from LTS. Meant as a flexible tool, adaptable to varied national context, the dashboard can serve as basis for the development of LTS financing strategies.

I4CE is hoping to launch a pilot study to put this dashboard into practice in the coming year.

This dashboard and associated user guide are available as annexes to the report.

How can we kick-start the financing of the transition? Where to start? In two minutes, Chloé Boutron from I4CE answers these questions and talk about the dashboard developped by the Institute.