The State of Europe’s Climate Investment, 2025 edition

A pivotal moment for the European Union: investment for decarbonisation, strategic autonomy and competitiveness

In a challenging geo-political context, Europe stands at crossroads. The attention in the European Union (EU) has pivoted towards security, strategic autonomy and competitiveness. At the same time, the EU’s climate leadership is needed more than ever. In this context, Europe has an opportunity to lead on both climate action, and industrial competitiveness and strategic autonomy, but this will only happen if ambitions are backed with real investments.

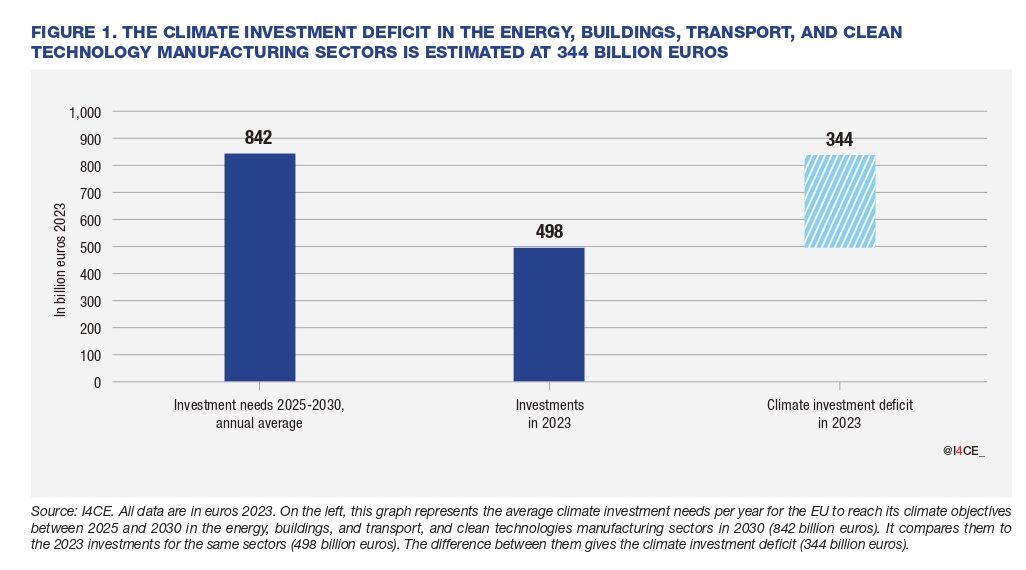

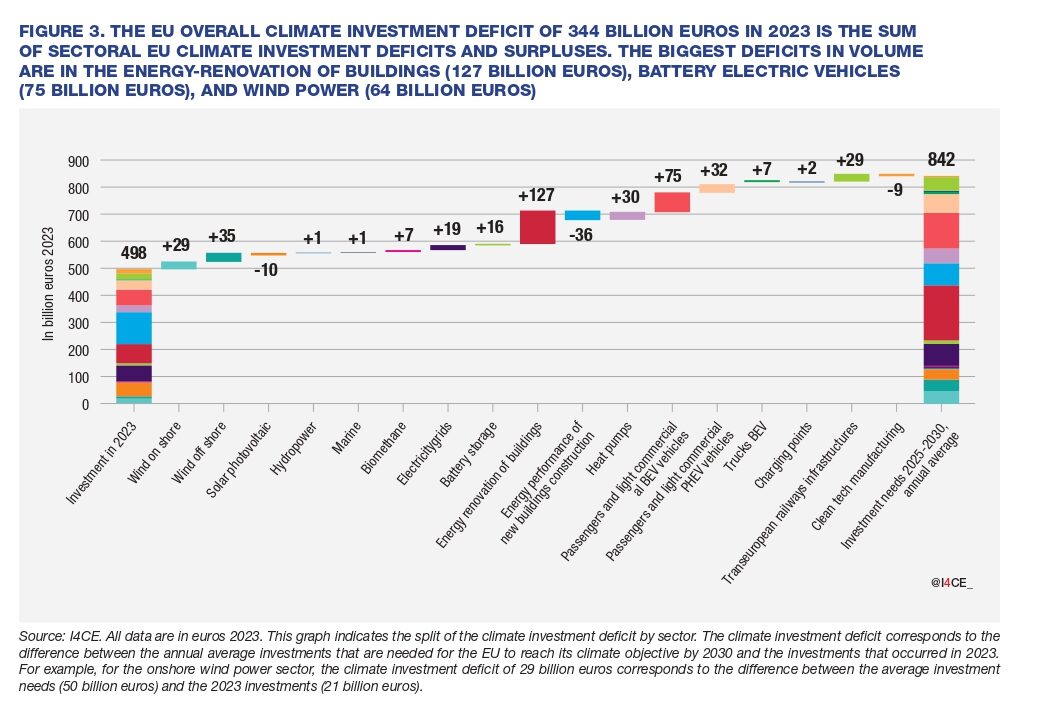

In 2023, climate investments in the EU reached 498 billion euros, well below the 842 billion euros needed on average each year to meet the 2030 EU climate targets, leaving a 344 billion euros gap. Early projections for 2024 suggest that key sectors like wind power, building renovation, and electric vehicles are at risk of decline. Cleantech manufacturing investments are gaining ground, but production of EU cleantech facilities is falling short of demand, putting many of these assets at risk. As the EU recalibrates around competitiveness and resilience, this report offers a stark reminder: climate policy without sufficient investment will not deliver, and the cost of delaying action will only rise.

Climate investments: uneven growth in 2023 and expected slowdown in 2024

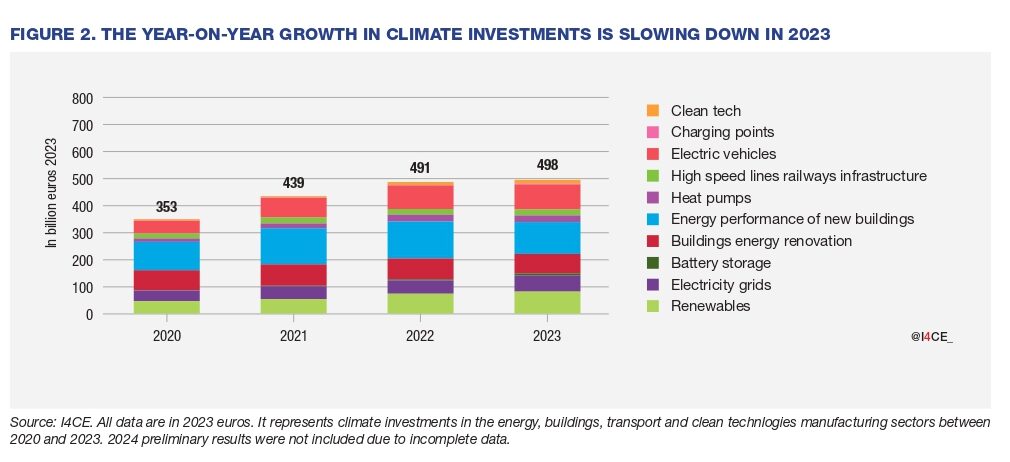

In 2023, climate investments in the EU reached 498 billion euros in the energy, buildings, transport and cleantech manufacturing sectors – or 2.9% of EU GDP. After years of significant growth, this represents an increase of only 1.5% compared to the previous year. This overall growth reflects mixed dynamics across sectors. This slowdown in the 2023 growth is mainly due to a contraction in new buildings construction investments. The building sector also suffered from a decline in renovation activity and heat pump sales. In contrast, investment in renewable energy, driven by solar power, and in electricity grids grew by 17% in 2023. The transport sector also saw an 8% rise in investment, driven mainly by the increasing adoption of battery electric vehicles.

Early 2024 investment estimates for some sectors bring a more nuanced picture. Several climate investments are expected to have decreased in 2024, including renewable electricity (-7.2%), buildings energy renovation (-6.3%), heat pumps (-26.9%) and battery electric passenger vehicles (-2.9%).

Investments in wind turbines, solar panels, batteries, electrolysers and heat pumps manufacturing reached 13.9 billion euros in 2023. Battery manufacturing accounted for 90% of these investments. Despite progress in scaling up cleantech manufacturing capacities, underused capacity and factory closures in solar, battery and heat pumps sectors illustrate the strain of global competition and weak local demand. A tendency that is not likely to improve in the short-term as a slowdown in renewables deployment, heat pumps installation and battery electric vehicles are expected in 2024.

Accelerating climate investments to stay on course for the 2030 targets

Reaching the EU’s 2030 climate and industrial policy objectives will require 842 billion euros per year on average between 2025 and 2030, – equivalent to 4.9% of EU GDP. As climate investments reached 498 billion euros in 2023, this leaves a climate investment deficit of 344 billion euros, or 2.0% GDP.

Most of the sectors studied in the scope of this report present a climate investment deficit, in various proportions. Some sectors are particularly far from reaching their 2030 targets. Wind power 2023 investment reached only 29% of what would be needed annually while investment in building energy renovation stands at around 34%. Finally, although investments in power grids have experienced strong growth in recent years, the 19 billion investment deficit needs to be closed as soon as possible as connection to power grids is one of the key enablers of renewables deployment and increased electrification.

On the other hand, 3 sectors present a climate investment surplus for various reason:

- the solar power sector shows an investment surplus of 10 billion euros, driven by a recent surge in solar installations that has put the EU on track to meet its sectoral targets.

- the energy performance of new buildings sector shows a surplus of 36 billion euros. This is largely structural and reflects the European Commission’s expectations of a slowdown in new construction in the coming years, particularly in the non-residential segment.

- the cleantech manufacturing sector has a surplus of 9 billion euros, entirely due to the battery manufacturing segment, where recent investments have aligned the sector with the European Commission’s desired targets set in the Net Zero Industry Act (NZIA) for this specific sector.

The investment surplus in new building construction is structural, driven by an expected decrease in new buildings construction while the surpluses in solar power and battery manufacturing are more conjunctural. These later simply indicate that the EU was investing at the right pace in 2023. Achieving the EU’s climate and industrial targets in these areas will require maintaining this pace over time. However, solar power investments are projected to decline by 5% in 2024, and battery manufacturing by 11%. If these trends persist, the EU may fall short of its targets in both sectors.

Looking ahead: Plan to invest, invest, invest

Overall investments growth in the EU’s climate transition is slowing down in 2023, and early indications suggest a decline in 2024. The EU needs to buck the trend rapidly by increasing annual investments or prepare to miss the 2030 emission reduction and cleantech manufacturing targets, but not only. The EU also risks underinvesting in the modernisation of its infrastructures, as well as in its efforts to achieve greater strategic autonomy and enhance its competitiveness. The impact could be picking up a higher bill further down the road, both in economic and ecological terms.

At the same time, several Member States are under pressure to decrease their public spendings following the implementation of the newly reformed EU fiscal rules. Also, the Recovery and Resilience Facility is set to expire by the end of 2026 and the payback of the grants and loans allocated under the NextGenerationEU should start in 2028, adding a further strain on spending capacity in the EU. Upcoming debates on the next EU multiannual financial framework (MFF) will likely focus on adapting structure and strategic investment to new priorities, increase of the EU’s own resources, and the possibilities for continued joint debt setting. If the MFF is an essential investment budget for Europe, it remains a limited share of total needs. Besides, a renewed and refocused MFF won’t begin until 2028 – just two years before the 2030 deadline.

Facing these challenges, the EU needs to frontload a well-informed and coordinated long-term investment framework, that includes a strategy for financing its ambition in term of climate, strategic autonomy and competitiveness, anticipating and tracking the development of investments over time. Establishing a long-term framework is all the more crucial given the short-term challenges currently facing public spending. Such a strategy would offer stability in turbulent times, providing predictability to private economic actors and help ensure the deficit is closed in a timely and cost-effective manner. This strategy must clarify the roles of public and private finance, using policy tools like fiscal levers, de-risking mechanisms, and regulation. NECPs should evolve into real investment plans at national level. An effective strategy requires granular data on sector-specific needs and spending in each Member State. Improving this data will enhance accountability and support a broader, more inclusive view of investment needs, covering other areas like agriculture and climate adaptation.