Taking a first STEP towards a cleantech investment plan

The EU’s Strategic Technologies for Europe Platform (STEP) is an important boost towards unlocking future cleantech public finance. In this blog post, Ciarán Humphreys argues that Member States should get behind a European solution.

The Strategic Technologies for Europe Platform – a partial solution in need of support

When it comes to cleantech, Europe must ensure deployment at a level that can lock in future decarbonisation, secure resilient supply chains, and build cleantech manufacturing to keep European industry competitive.

The bloc’s largest economies see the need to make dramatic domestic moves to shore up their own share of the technologies of the future – backed by billions of Euros of public investment. Yet many Member States, with greater fiscal constraints, are not able to compete on a level playing field. A solution that supports all Member States will need to be at EU level – the Commission’s Strategic Technologies for Europe Platform (STEP) points the way towards such a solution.

Yet STEP is not without its flaws. While it does make the important move of outlining critical technologies for European support and targeting existing funds towards those priorities, its proposed injection of €10 billion does not make a significant dent in the investment needed to support them. These critical technologies include not only cleantech but other sectors such as artificial intelligence, quantum computing and biotech. The amount of funds available for cleantech will therefore be further limited. Furthermore, Member State support for this new funding stream is low, meaning even this small top-up might be negotiated down to virtually nothing in the coming trilogues between capitals and the EU.

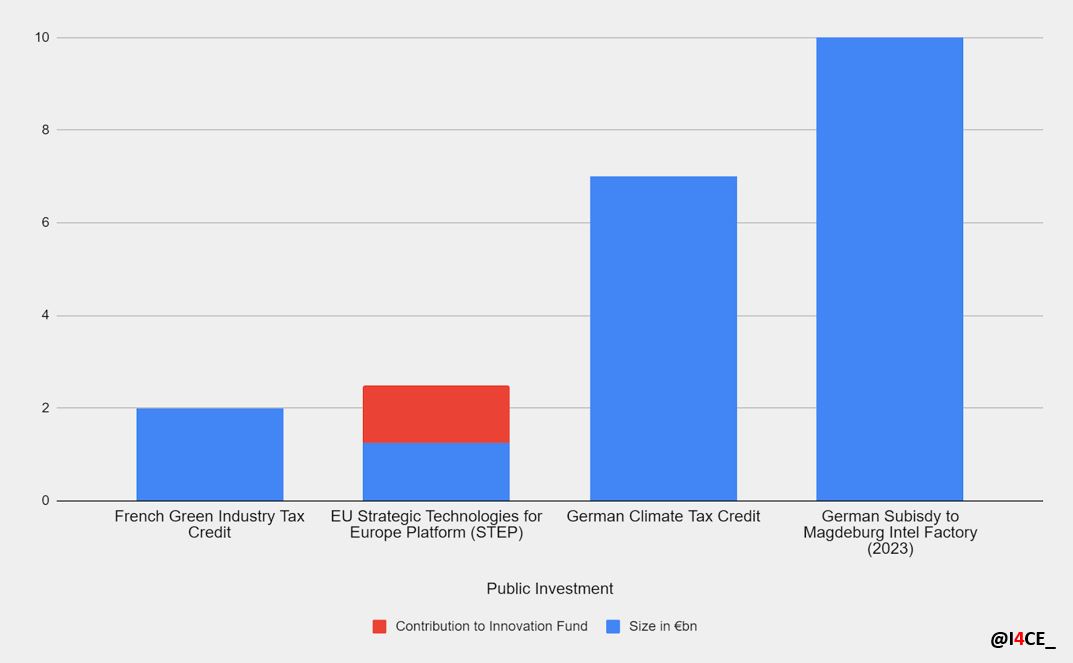

Figure 1 – The Strategic Technologies for Europe Platform in Context (Average annual size – €bn)

However, as the International Energy Agency reminds us in its latest report, the pathway for achieving 1.5°C is narrowing every year. European governments cannot let perfect be the enemy of good. With some changes, and enthusiastic support from Member States already calling for “innovative” EU industrial policy, STEP can start the EU on the path towards a more ambitious solution: a cleantech investment plan.

Larger member states are not waiting for the EU on climate investment

From the US to China, active trade and industrial policy are increasingly de rigueur – particularly when it comes to cleantech. European capitals are responding in kind: French President Emmanuel Macron’s longstanding calls for “strategic autonomy” are now joined by German Economy minister Robert Habeck’s turn towards “economic security” and “selective multilateralism”. It would be a mistake to think that individual countries are the right vehicles to defend against such an significant challenge to the bloc.

Europe’s largest economies, France and Germany, are planning large public investments to support these goals. In part buoyed by relaxation of Europe’s state aid rules (which Paris and Berlin have benefited from the most, accounting together for 71% of aid authorised under the new regime), both have announced significant public schemes to support their domestic green transitions. Take, for example, Germany’s climate tax credit of €7 billion per year, or France’s announcement of a €2 billion green industrial tax credit (see Figure 1).

This nationally-centred approach is far from a European solution to the shared need for cleantech investment, to which these Member States have only so far paid lip service. If this trend continues, we will progress towards a fragmented Europe for cleantech – between those countries with the financial firepower, skills and resources to support their own domestic industries, and those who lack the means or material to contribute. The issue isn’t that national programmes will not succeed at all, but that – by definition – the restriction to national champions will again breed “winners” who are unable to compete on a larger stage.

A European response is needed, but has so far underwhelmed

In Brussels, progress has been made towards a European solution. The Net Zero Industry Act (NZIA) (the regulatory pillar of the EU’s Green Industrial Plan) seeks to accelerate permitting and give priority status to cleantech manufacturing projects.

The proposed Sovereignty Fund, presented alongside the NZIA as the financial pillar of the Green Deal Industrial Plan, was expected to complement the regulatory push of NZIA with public finance. By targeting support to those Member States without the fiscal space to exploit state aid relaxation, the goal had been to ensure that the EU as a whole could make the necessary investments in cleantech.

What has since emerged, the Strategic Technologies for Europe Platform (STEP), falls short of the scale needed to be internationally competitive. Announced in June, STEP is largely a reorientation of existing finance streams (including the Cohesion Funds and Recovery and Resilience Facility) towards three strategic technological sectors, namely cleantech, deeptech and biotech. It also calls for an injection of €10 billion of fresh Member State money into four EU funds: InvestEU (€3bn), Horizon Europe (€0.5bn), the European Defence Fund (€1.5bn) and the Innovation Fund (€5bn).

From a climate perspective, the €5 billion for the Innovation Fund is most promising. Recent I4CE analysis identifies Europe’s largest dedicated climate fund as the best tool bridging the cleantech investment gap in the short and medium term. To do so, it needs more funding – something which STEP and subsequent bigger envelopes can provide.

Is adding €5 billion in STEP enough? To put this level of investment into perspective, Germany gave out €15 billion – more than the national budget of an EU Member State such as Latvia – to support two chip factories in 2023 alone (€10 billion for one chip plant in Magdeburg and another €5 billion for another chip plant in Dresden). The EU offer pales in comparison.

There are also conditionalities on how the additional money should be used. It should only be offered to Member States whose GDP per capita is below the EU average, and with projects that align with the STEP objectives (building up tech development and manufacturing, addressing shortages of labour and skills). According to the text, this should be done under a separate call within the Innovation Fund.

With both national state aid for cleantech and awards of Innovation Fund grants currently heavily weighted towards the richest Member States, such an attempt to target fresh funds towards less wealthy countries is understandable. This conditionality would also direct funds towards Member States with low investment but high potential of developing their own cleantech industries, such as Spain, Italy and Poland.

In the short term, STEP therefore is a positive move forward in ensuring the cleantech transition is truly Europe-wide. However, in the interest of long-term efficiency of public spending, more systemic efforts are required. Simply mandating that a proportion of EU funds support projects in less wealthy Member States is not sufficient to build lasting cleantech competitiveness – and should not be depended upon. Public action at EU and Member State level to build the enabling infrastructure, develop the local skills base and incentivise home-grown cleantech scale-ups should be a priority to make the most of the potential of the cleantech single market.

Small though it may be, STEP is under attack

Today, the European Parliament’s budget and industry committees will vote on the parliament’s amended version of the STEP regulation. The file has been fast tracked through the EU legislative process, with the aim to conclude trilogues by the start of next year.

In the Parliament the debate around the Net Zero Industry Act has focused on which technologies should benefit from a range of regulatory measures – whether it should focus on a small range of cleantech sectors or be widened to the whole industrial base. A similar dynamic is now playing out around STEP. If the scope of STEP were to be widened beyond critical technologies, this would render the Platform largely ineffectual. The small amount of fresh money is hardly enough to make a dent in the cleantech investment gap (not to mention the considerable investment needs of deeptech and biotech) – spreading the €10 billion even thinner will rob it of the ability to make any impact on any technology.

The challenges for STEP are not over even when it leaves parliamentary negotiations, however – Member States are likely to gut it in trilogue negotiations. It can be expected that, when they have the chance, they will be loath to contribute the further €10 billion, further limiting its size and impact.

A first STEP towards impactful cleantech finance

Recently, French and German researchers, with the support of their national governments, published a report that outlines a vision for the future of the EU. In it, the authors recognise that an EU that seeks to support Ukraine, welcome new Member States and decarbonise its economy needs a significantly larger budget. To put that vision into practice, albeit in a very limited manner, this brief recommends that EU Member States:

- Ensure adequate funding for STEP, with the Commission’s proposal of €10 billion representing a modest level of funding compared to existing subsidies by some large Member States (see Figure 1),

- Keep STEP focused on critical technologies, including critical cleantechs. As funding will remain limited, it must be focused on sectors where EU-level funding can have the greatest impact,

- Support the Innovation Fund and make building Europe-wide cleantech competitiveness a priority. The Innovation Fund should be recognised as Europe’s best tool for supporting cleantech, and its prominent role in STEP preserved. It points to the need for more ambitious action to build up cleantech across the bloc, to ensure more Member States can compete on future EU-wide funding calls. At EU-level, the first priority should be even further expanding the size of the Innovation Fund, as I4CE has proposed in a recent report, by €22 billion between 2025-2029.

- Positioning STEP as the path to greater future ambition. While it has its flaws, STEP does show the way forward for how the EU should support cleantech for decarbonisation, resilience and competitiveness. By mobilising existing funds, targeting others towards strategic priorities, and with an injection of fresh capital from Member States, the EU can bridge the cleantech investment gap quickly without opening the pandora’s box of negotiations around a new fund. STEP, however, is simply too small – as I4CE has already outlined, a much more sizable cleantech investment plan is required.

The challenge to Europe’s cleantech industry posed by global competition and the need for accelerated deployment calls for European action – not the piecemeal Member State response we have so far seen. STEP points the way towards that action. It is up to Member States to think beyond the short term of domestic politics and back the Platform, to bring Europe closer to an ambitious solution to the cleantech financing problem.

The author would like to thank Damien Demailly, Thomas Pellerin-Carlin, Xavier Sol and Peter Sweatman for their valuable comments on this blog post.