Investments to decarbonise heavy industry in France: what, how much and when?

Industry: relocation and decarbonisation at the heart of the debate

The recent succession of crises (health, energy, geopolitical) and increased international competition have prompted France to look for ways to strengthen its industrial and energy sovereignty. It faces this challenge in addition to the challenge of decarbonising its industry. In this context, France and Europe are developing industrial policies with two objectives – relocation and decarbonisation – and with new tools such as the France 2030 plan and the Net Zero Industry Act at the European level. These policies target both “historical” industries, such as steel and cement, and new clean technologies, from solar panels to batteries.

Industry is a high-emitting sector, accounting for 20% of total territorial greenhouse gas emissions. According to the National Low-Carbon Strategy (Stratégie Nationale Bas-Carbone, SNBC), in order to reach carbon neutrality by 2050, these emissions will need to be reduced by 81%. A considerable proportion of industrial emissions are concentrated in the “heavy industry” sectors. Located upstream on the production chain, heavy industry is characterised by a small number of production sites and emissions linked to both the energy used and the production processes themselves. The current SNBC sets a decarbonisation course for the industry but provides very little detail on the technologies and public policies that will be required.

In this study, we estimate the investment needs of four heavy-industry sectors: steel, cement, high-value chemicals, and ammonia, which together represent about half of industrial emissions in France. This is key information: knowing the amount and pace of deployment of investments is essential towards identifying financing needs and calibrating the need for public support to industry.

A method for estimating investment needs under various decarbonisation scenarios

To shed light on the investments required to decarbonise the heavy-industry sector we have developed a method to estimate investment needs, on site, for the four industrial sectors selected. We applied the method to four contrasting scenarios for achieving carbon neutrality, developed by ADEME within the Transition(s) 2050 project.

The estimates of investment needs correspond to the cumulative investments required to transform the existing industrial base by 2050 and cover both the maintenance and decarbonisation of existing equipment and the deployment of new technologies on production sites. We do not cover equipment operating costs, nor measures related to adaptation to climate change.

By estimating the investment needs on the production sites themselves, we are ignoring for now the investments needed elsewhere to decarbonise the industry: infrastructure for low-carbon energy production and transport, hydrogen transport and CO2 transport and storage.

From €3 to €14 billion of investments: which industry for tomorrow?

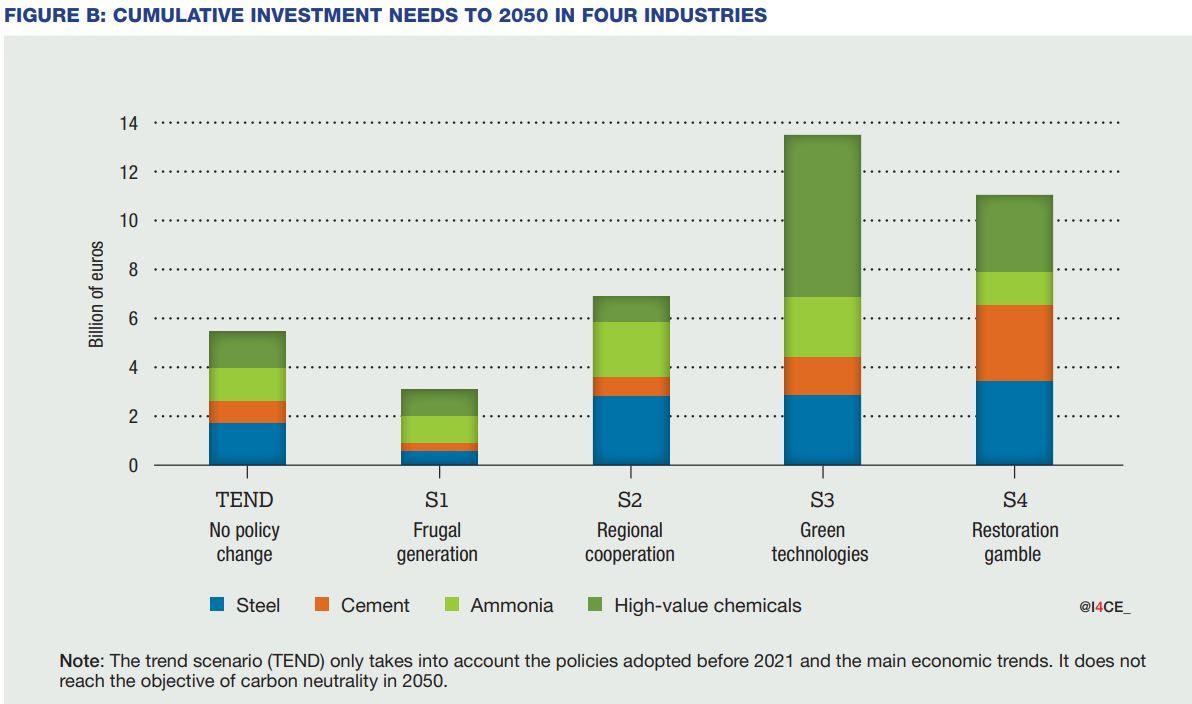

The investment needs to decarbonise steel, cement, high-value chemicals, and ammonia production range from €3 billion in ADEME’s S1 “Frugal generation” scenario to €14 billion in its S3 “Green technologies” scenario.

The first striking result is the size of the gap between the investment needs of the different scenarios. This difference essentially reflects two interdependent characteristics of the decarbonisation scenarios: the level of industrial production and the production technologies used. The scenarios that anticipate the highest demand for industrial products require major investments to replace existing processes with new ones that emit less. Conversely, scenarios that rely on other economic activities becoming less dependent on materials (e.g., less new construction in the building sector, or more recycling and reuse), can retain existing technologies, which require less new investment. Depending on the decarbonisation scenario studied, the investment needs at production sites therefore vary greatly.

Investments to be made quickly

In addition to the difference in investment needs between the scenarios, what is noteworthy is the apparent weakness of the estimated amounts: €14 billion for the most investment-intensive scenario by 2050. It is important to bear in mind that these estimates relate to less than half of industrial greenhouse gas emissions, and sectors whose production is concentrated in a small number of sites. Decarbonising the entire industry will therefore require much more investment. Moreover, these investment needs are limited to production sites, and do not include the investment required in the infrastructure on which they depend.

Above all, although the objective is carbon neutrality in 2050, investments will have to be made in the next few years. The 2030 decarbonisation targets and the end of free allowances in the European Union Emissions Trading System are an incentive to invest quickly to decarbonise industry.

We have built investment deployment trajectories that reflect these incentives and also incorporate several sectoral and technological constraints, such as equipment renewal cycles and the deployment time of certain technologies. Depending on the scenario, between 55% and 80% of investment is deployed before 2035.

Better planning for industry transition

In order to rapidly deploy industry decarbonisation investments, the State must develop effective plans for carrying out the necessary transformation. This uncertainty is logical; after all we cannot know precisely the shape of tomorrow’s economy and technologies. But this level of uncertainty poses a problem. It poses a problem for private players: will the industries studied need to invest €3 billion or €14 billion ? It poses a problem for the State and, more generally, for public players: what aid and what budget should be allocated to the decarbonisation of industry? The State and industrialists will have to clarify the strategy for decarbonising the industry, including the development of the necessary infrastructure, and ensure that it is consistent with the decarbonisation of the other sectors.

Detailed data and the model used to estimate investment needs presented in this report will be published later this summer.

With the support of