Landscape of Climate Finance in France – Edition 2023

I4CE‘s Landscape of Climate Finance is an overview of climate investments made by households, companies and public authorities. Such investments include retrofitting buildings, purchasing electric vehicles, installing renewable energy, as well as paying for rail, cycling and urban public transport infrastructure.

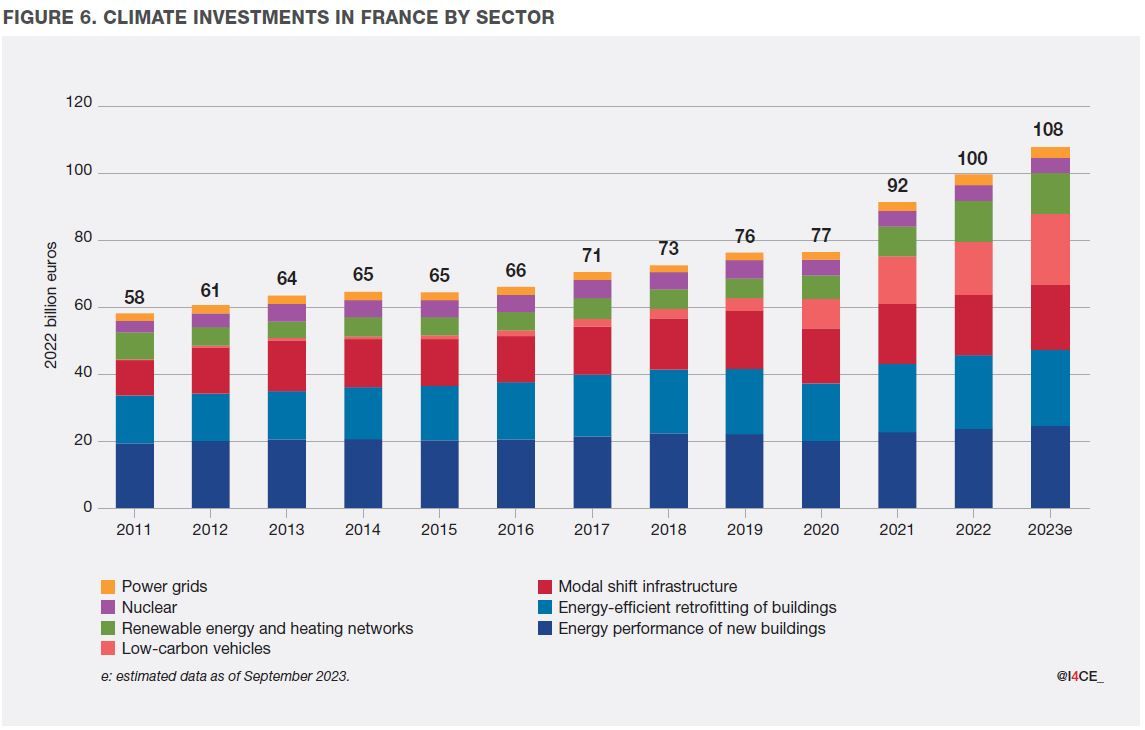

In France, climate investments reach €100 billion but remain insufficient

Climate investments by households, companies and public authorities reached €100 billion in 2022. Compared with 2021, investments in electric vehicles, renewable electricity generation, electric grids and retrofitting of buildings have increased. Rail infrastructure and nuclear power investments remained stable. Early data show climate investments increasing in 2023 as purchases of electric vehicles rose.

Further investments are needed, however, to significantly reduce greenhouse gas emissions. The draft scenario of the French national low-carbon strategy (Stratégie nationale bas-carbone, SNBC) gives a first insight into climate investment needs. Compared with 2022, each year between 2024 and 2030 an additional €58 billion will be needed to meet climate investment targets. The needs are concentrated in retrofitting of buildings, electric vehicles and railways.

A third of climate investments are funded by the public sector

While most climate investments are made by households and companies, public authorities financed a third of expenditure in 2022. The share of public funding varies widely depending on the sector, from 17% for low-carbon vehicles and renewable energies to 92% for transport infrastructure. It includes national and local government expenditures, loans and holdings by public banks, and the resources of public housing authorities and infrastructure management companies. In addition, the government has a stake in companies such as EDF and SNCF, and regulates corporate investment in the electricity and gas networks.

As a result of the COVID‑19 recovery plan adopted at the end of 2020, government spending on climate action increased in the sectors studied in 2021 and 2022, but early data show a sharp fall in 2023. A large part of this decline is due to the levelling off in 2022 of public service electricity charges (Contribution au service public de l’électricité, or CSPE) against high electricity and gas prices, and has no impact on funding of new projects. However, early data show public spending on railways, cycling infrastructure, urban transport, building retrofitting and electric vehicles remaining stable in 2023, while the costs of these projects are rising. The 2024 budget, presented in autumn 2023, provides for an increase in expenditure across the broader scope of ecological planning.

Main trends in four key sectors

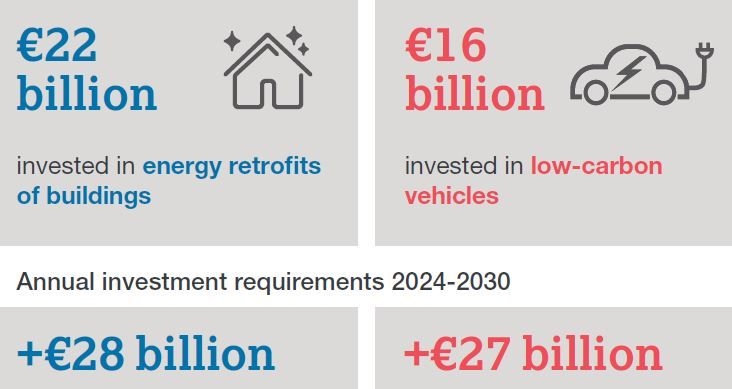

Annual investment in energy retrofitting of buildings is rising, reaching €22 billion by 2022, but the proportion of deep renovation remains low. Subsidies for home retrofitting and recovery plan funding for public building retrofitting have sustained investment after a decline during the pandemic. Purchases of older properties, which are a prime opportunity for deep renovations, are declining as bank lending rates rise. The draft scenario of the national low-carbon strategy targets more deep renovations, particularly in energy-intensive buildings, requiring an additional investment of €28 billion per year between 2024 and 2030.

Investment in low-carbon vehicles, particularly electric vehicles, is growing rapidly, reaching €16 billion in 2022, driven by the momentum created by the European regulations that entered into force in 2020, as well as by national subsidies and regulations. The extended range of batteries and the growing density of the recharging network are contributing to the rise of electric vehicles purchases. However, demand for electric light and heavy goods vehicles is still low. The gradual electrification of all segments would lead to additional investment of €27 billion per year between 2024 and 2030.

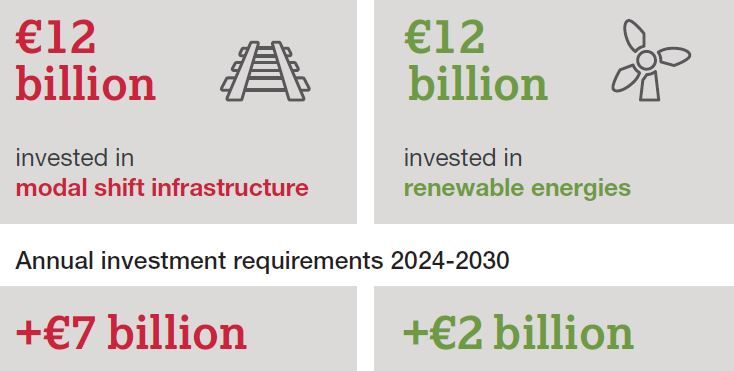

Investment in railways, cycling lanes and urban transportation increased slightly in 2022, reaching €12 billion. Deployment of major projects, such as the Grand Paris Express and the Seine Nord Europe canal, has contributed to the increase in investment. Investment requirements for 2024‑2030 amount to €6.5 billion above the 2022 level, while public support for the sector is expected to decline slightly in 2023.

Investment in renewable energies rose sharply to €12 billion in 2022. This record level can be explained by the dynamism of offshore wind power projects and the increase in installation of photovoltaic panels for self-consumption of solar power. Investment in renewable gas and heat is stable. Although the rise in the price of fossil gas has made these projects more profitable, their cost has risen sharply due to shortages of materials. Annual investment needs in this sector are estimated at an additional €2 billion, with the rapid increase in the rate of installations being offset by the anticipated fall in equipment costs.

In 2024, the government will have to lay out its strategy for financing the transition

In 2024, the government will have to introduce its multiannual strategy for financing the ecological transition (Stratégie pluriannuelle pour le financement de la transition écologique, SPFTE). This will provide an opportunity to better identify the public and private funding that will be needed to bring the country’s investments up to the level of its climate objectives. The I4CE Landscape already provides a solid basis for this strategy.