FOREWORDS

Jean Pisani-Ferry, Chair of I4CE

Yet as it is developing, the climate debate is simultaneously becoming polarised. This is true in the United States, where Paul Krugman recently observed that climate has become an issue in the culture war between Democrats and Republicans. It's true in Europe, where conservatives have gone on the offensive against the Nature Restoration Act, and the German Finance Minister is railing against Brussels' green plans.

It's true in the UK, where Prime Minister Rishi Sunak is tempted to present himself as an advocate for the middle classes and a defender of a way of life put at risk by decarbonisation targets. It is true, of course, in France.

It is in this new, more difficult context that we must intervene. Before, we only risked being met with indifference. Now we run the risk of being used as instruments in the political and cultural controversies of others. We're going to have to be extremely vigilant to prevent these dangers, and very firm in our stance: our only cause is that of climate action, which we want to be swift, impactful and socially just.

The forthcoming debates on the French finance bill and, very soon, the campaign for the European elections, will be a test of our mettle. We will approach them well aware of the risks and determined to live up to our responsibilities.

Benoît Leguet, Managing Director of I4CE

The same type of debate will have to be held in Europe, when the Parliament and the Commission come up for re-election in 2024, because the European Union will now have to finance its Green Deal. Faced with the Inflation Reduction Act in the United States and China, it cannot be both the best performer in terms of environmental regulations and the worst performer in terms of financing.

In particular, we need to stop treating the financing of the Green Deal in silo with the Stability and Growth Pact and European debt, when we know that the need for private and public money will increase to finance the transition. In 2022, I4CE set up a dedicated team to contribute to these debates, and to ensure that Europe also adopts a plan for financing the transition.

Internationally, the same questions arise, and in an even more complex way for developing countries. It is true that they are drawing up long-term strategies to reconcile climate and development, but how will they finance them? They too need a financing plan that enables them to manage their transition, corresponds to their needs, and intelligently combines their national resources and external resources, particularly those provided by international development banks. I4CE works with these banks and helps developing countries to equip themselves with tools for analysing and financially managing their transition.

This annual report details our contributions and our impact on these issues. And on others subjects, always linked to the financing of mitigation and adaptation. As much on France, more about Europe and more international. We are continuing to build on our momentum.

#Mission

![]()

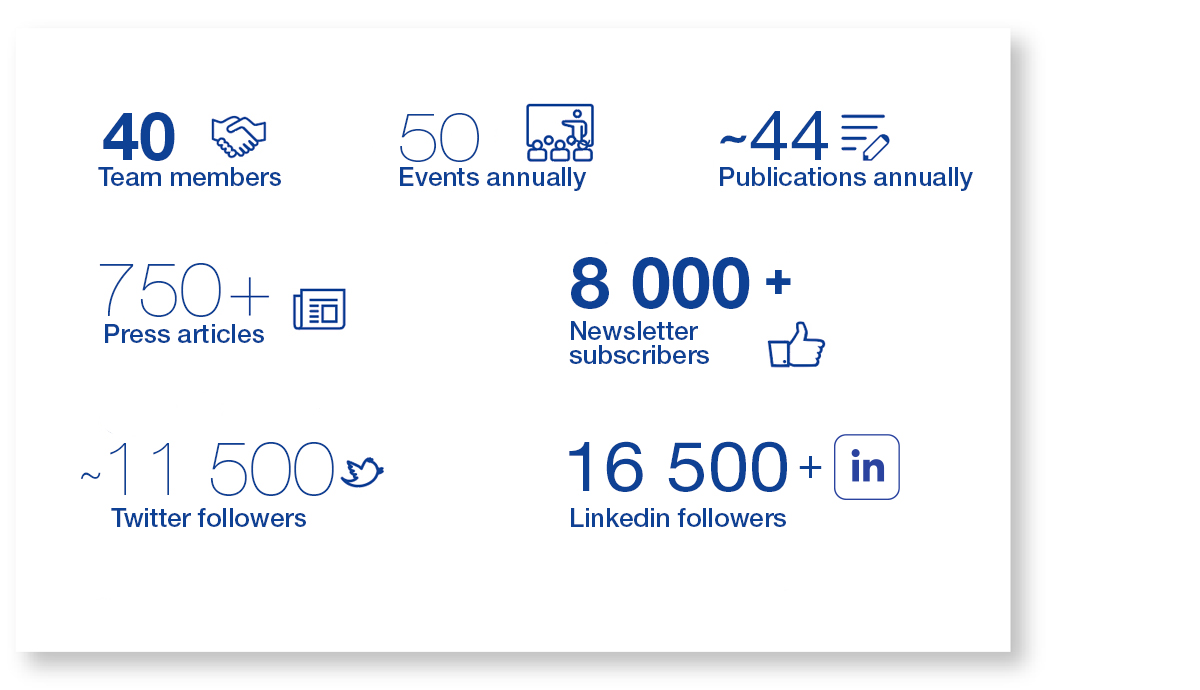

I4CE is a non-profit research organisation that provides independent policy analysis on climate change mitigation and adaptation. The Institute promotes climate policies that are effective, efficient and socially fair.

Our 40 experts engage with national and local governments, the European Union, international financial institutions, civil society organisations and the media.

Our work covers three key transitions – energy, agriculture, forest – and addresses six economic challenges: investment, public financing, development finance, financial regulation, carbon pricing and carbon certification.

#I4CE_Figures

IMPACTS

EUROPEAN INVESTMENTS

#EUROPE

The Inflation Reduction Act changes the game

Unfortunately, this is not yet the case, although some initial progress has been made. For example, the Commission is now recommending that Member States draw up and publish their financing plans for the transition, as part of their national energy and climate plans. It has also launched a programme to help Member States with green budgeting, with I4CE and Expertise France, in which we have trained over 300 officials from the finance and environment ministries.

This is just a modest start for the EU. The negotiation of the EU's multiannual budget framework and the European elections will provide further opportunities to ensure that Europe is not only the best leader on climate regulation and carbon pricing, but also becomes the best leader on financing the transition. I4CE will publish new data on the need for climate investment in the EU soon.

#I4CE_Report

For an EU cleantech investment plan

With the Inflation Reduction Act, the United States is rapidly catching up in the race for clean technologies. This note argues that the EU’s best political response to the IRA is a long-term European climate investment plan. As the political appetite for such a plan is currently limited, the European Commission should take advantage of the political momentum generated by the IRA to propose an investment plan focused on clean technologies. I4CE identifies three initial building blocks for such a plan.

#Press

Europe needs an investment plan to win the global cleantech race

Since August 2022 and the adoption of a new public investment plan for the climate in the United States, the global race for clean technologies has switched gears. The EU has the advantage of having a coherent set of climate regulations and carbon pricing. What it needs now is a long-term investment plan, explains I4CE’s Thomas Pellerin Carlin in this article for Euractiv.

#I4CE_Project

ECNO: European Climate Neutrality Observatory

The EU is neither comprehensively nor sufficiently monitoring the transition to climate neutrality. This is why ECNO, an initiative led by a consortium of research organisations including I4CE, is providing a series of progress indicators to present a single, up-to-date picture of the decarbonisation of the economy as a whole. ECNO also identifies the data gaps that need to be filled at a European level, particularly on the financing of the environmental transition.

#I4CE_Report

Factors for the successful implementation of green budgeting in EU Member States

To ensure that the transition is properly financed, it is helpful to know, at the outset, which budget expenditures facilitate or hinder the transition. To encourage the adoption of green budgeting processes in Member States, the European Commission has launched a capacity-building programme in several European countries with I4CE and Expertise France. We have trained over 300 officials from finance and environment ministries. This report presents the lessons learned from the programme.

FINANCIAL REGULATION

#EUROPE

No 'pause' for European financial regulation

While it's still too early to assess the results of this strategy, one issue has made good progress: the requirement for banks to draw up climate transition plans. We at I4CE are delighted with this development, as we have been working for several years to put this issue on the agenda and explore the conditions for its impact on financing the global environmental transition. Over the past twelve months, it has made its way into the European regulatory debate, whether in the CSRD directive on corporate sustainability reporting, the CRD on prudential requirements for banks, or the CSDDD Corporate Sustainability Due Diligence Directive.

Together, all these directives can make a real difference. As always, the devil is in the details. Effective tool or waste of time? The future of environmental transition plans will be decided in the coming months.

#I4CE_Report

Implementing prudential transition plans for banks

The European Union has made rapid progress on the issue of environmental transition plans for banks. One thing which still needs to be clarified is if, and how, these transition plans will be integrated into prudential regulation, which would clear the way for many possibilities for actions and sanctions taken by supervisors. To understand the use of such an integration, I4CE published a qualitative analysis of the expected impacts in 2022.

#I4CE_Report

Climate stress-test: what co-benefits for financing environmental transition?

In early 2023, the European Commission launched a new climate stress-test drill that covers the entire European financial system. While not the first goal of these exercises, I4CE analysed the drills’ impact on the financing of the environmental transition. This study shows that, to date, if some banks and financial supervisors have received undeniably interesting co-benefits, the impact was limited, and it will likely remain limited.

#Press

Corporate due diligence: what added value for the climate?

The CSDDD is not the first directive to require companies, financial or otherwise, to account for their climate transition plans. But it could go further, requiring them to draw up and implement a plan, and creating possible sanctions. I4CE’s Romain Hubert explains the details of the CSDDD and its relationship with other directives in this article for Euractiv’.

#I4CE_Report

The limitation of voluntary climate commitments from private financial actors

Why is it necessary for public authorities to regulate private finance, for example by demanding that banks adopt climate transition plans, as opposed to counting on voluntary climate commitments? Because, as I4CE shows in this Climate Brief, voluntary climate commitments from private financial actors must face important obstacles that limit their effectiveness. While beneficial and worthy of encouragement, we cannot expect more from these initiatives than what they can actually accomplish.

PUBLIC DEVELOPMENT BANKS

#INTERNATIONAL

2023, a year for reform

I4CE works closely with these financial institutions, acting as a scientific secretariat for the Mainstreaming Climate in Financial Institutions initiative, which brings together some fifty financial institutions. We are convinced that the current reform must not only increase the financing capacity of international public banks, but also the impact of every dollar spent. We need to put international public money where it has the most structural and transformational impact. These banks can do many things to achieve this, and in particular they can start from the needs of developing countries by supporting the development of their long-term climate strategies. This is one of the conclusions of the Paris Summit for a New Global Financing Pact, held in June 2023 and for which I4CE was strongly mobilised. There are still many steps to be taken to complete the reform, from the World Bank Annual Meetings to COP28, and we invite you to follow them with us.

#I4CExpertViewPoint

World Bank’s alignment approach: Ambition is the Missing Ingredient

After years of waiting, the World Bank has finally published its Alignment Approach with climate goals. This is an important step towards reforming the World Bank. But this approach will not be enough, as Alice Pauthier and Sarah Bendahou of I4CE explain in this post. The authors make a few proposals to raise its ambition.

#I4CExpertViewPoint

2023, an impactful new year for financial reform

In 2022, an international consensus was reached: the global financial architecture is no longer adapted to today’s challenges. 2023 is a year of reform for development financing, with numerous events organised, including a summit in Paris in June. While discussions have centred around the need to seriously increase financing for development, Alice Pauthier returns to the importance of putting impact at the core of a reform that will have to be guided at local level, by identifying the financing needs of environmental transition.

#I4CEvent

Maximizing impact of development finance institutions tomorrow

Organised by think tanks I4CE, World Resources Institute (WRI) and Climate Policy Initiative (CPI), this side-event at the Summit for a New Global Financing Pact brought together international financial institutions, their shareholders, recipient countries and NGO experts to discuss how best to deploy international development financing – while ensuring maximum efficiency – according to countries’ specific needs.

#I4CE_Report

Supporting financial institutions in developing countries in their alignment journey with climate goals

How can we maximise the impact of international financial institutions? One example can be found in this report, written in partnership with the NewClimate Institute, which presents recommendations for international financial institutions to support the alignment of their partner financial institutions in developing countries with the objectives of the Paris Agreement. And, more broadly, to contribute to the transformation of local financial systems.

#ClimateClub

A tool dedicating to supporting financial institutions in their alignment process

The Climate Mainstreaming Resource Navigator was developed by the Mainstreaming Initiative, for which I4CE provides the secretariat. It brings together resources on integrating climate into the strategy and operations of financial institutions.

TOOLS FOR STEERING THE FINANCING OF ENVIRONMENTAL TRANSITION

#INTERNATIONAL

Financing plans for all countries

Ideally, each country would draw up a plan for financing the transition, clarifying expected public spending, the resources that can be mobilised and the role of the various economic players. A financing plan developed by each country and based on its own long-term decarbonisation strategy, its long term strategy (LTS), to reconcile climate and development. This was the message brought by I4CE to the last COP, where the team organised numerous events. And to move towards this ideal and enable countries to to develop and to discuss the financing of their transition, I4CE is contributing to the development and dissemination of tools for steering the financing of the transition. This toolbox has recently been expanded, with the launch of a dashboard for finance ministers to assess, act on and monitor the economic implications of environmental transition.

#I4CE_Report

The economic implications of the transition: an LTS dashboard for finance ministers

To support finance ministries, I4CE and the 2050 Pathways Platform have developed a dashboard model containing economic indicators for assessing, acting on and monitoring the economic implications and opportunities arising from long-term strategies (LTS). Designed as a flexible tool and adaptable to a variety of national contexts, the dashboard can serve as a basis for finance ministries to develop LTS financing strategies.

#I4CE_Report

Long-term strategy use for Paris-aligned investments

To ensure that international public finance is channelled to where it is needed the most, it is important that all countries adopt Long-Term Strategies (LTS) as required by the Paris Agreement. This I4CE report explores the possible roles of both the LTS development process and the resulting LTS document in providing insights for Development Finance Instituitons. The findings are relevant for a broader range of financial institutions.

#I4CEvent

Financing the transtion in developing countries

Would you like to find out more about the financing challenges that developing countries face in tackling climate change, whether that’s mobilising significant budgetary resources, redirecting public funding flows or aligning their financial systems? Want to hear from experts and practitioners and their ideas for reform? The replay of this I4CE side-event at the COP is for you.

#I4CEvent

Planning the transition

Tracking public and private climate investment flows is essential for countries to assess their progress, identify investment needs and develop financing strategies. However, there are gaps in the tracking and reporting of these flows. To find out more, watch the replay of this I4CE side-event at the COP.

FORESTRY & WOOD

#FRANCE

Reality catching up to the French carbon sink

So, what to do? First, properly invest in forests to make them more resilient. I4CE has assessed the financial and human resources required to adapt French forests. Governments also need to promote the forestry practices that store the most carbon, hence the importance of the qualification framework being built on a European level, an endeavour that I4CE has been a part of after doing the same in France with the French Label Bas-Carbone.

The French carbon sink also depends on what is done with the wood harvested in French forests. Long-lasting products have a significant advantage: they store carbon over time. I4CE helped put this topic on the agenda of public policy makers, but although the awareness is there, policy makers remain unsure over which directions to take in order to develop the most promising sectors. Some European countries have succeeded, and I4CE is currently analysing their efforts in order to inspire similar environmental planning in France.

#I4CE_Report

Carbon sink: which wood products to bet on?

There is a consensus that, if France is to become carbon-neutral, it needs to develop the production and consumption of “long-life” wood products, i.e. products such as frameworks or wood-based panels that can store carbon over time. I4CE has reviewed these products, the technical constraints on their production, and possible outlets on the French market, and proposes initial avenues for developing these sectors.

#I4CE_Report

Adapting French forests: investing wisely

Adapting French forests to better survive climate change is an important political issue. From droughts to forest fires, the consequences of climate change on the population are more and more visible. Adaptation is indispensable if forests are to play the central role expected of them in mitigating climate change.

#ClimateClub

Forest and Wood Climate Club

Today, carbon has a real value thanks to the emergence of various national and international markets set up following the Kyoto Protocol. However, the forestry and wood sector is only slightly affected by these incentives, mainly through the use of wood energy. The objective of the Forest and Wood Climate Club is to share knowledge on the technical and economic means to develop and enhance the role of the forestry and wood sector in the fight against climate change. It aims in particular to enable companies and local authorities to access the carbon markets through the French forestry and wood sector.

#I4CE_Report

Recommendations for a European carbon certification framework

To encourage carbon storage, the European Commission aims to create a carbon certification framework. The goal is to create a common and harmonious framework on a European level, using expertise acquired through pre-existing certification frameworks. With this study, I4CE proposes 7 recommendations, inspired by both our concrete experience with the French Label Bas-Carbone that we contributed to and by 15 years of research on carbon certification.

#Press

Carbon certification: an unlikely alliance

The future European carbon certification framework is the subject of heated debate. The first meeting of the expert group tasked with supporting the Commission drew criticism for its composition and mandate, and discussions took an unexpected turn when they achieved the feat of getting NGOs and the CO2 Capture and Storage (CCS) industry to agree against natural carbon removals, whether from our forests or agricultural soils. Where does this unlikely alliance come from?

AGRICULTURE & FOOD

#FRANCE

A laisser-faire attitude is a lose-lose strategy

Needs must, because as I4CE shows, the current dynamic is a lose-lose situation. A loss for farmers, because livestock numbers are already on the decline, a decline that is not planned, but suffered, and not without consequences: many farmers’ assets are losing worth, and their retirements are at stake. A loss, too, for the climate, since meat consumption is not on the decline, and France is importing more and more meat.

This laissez-faire approach to the meat industry is a detrimental. It should incite serene and long-awaited discussions about the future of rearing to find win-win scenarios instead. I4CE and other think tanks have already undertaken this endeavour, and engaged with players in the sector. This must be accompanied by a reform in politics of consumption and public financing to help farmers through the transition. The transition of the meat industry and more widely agriculture in general must be publicly financed if it is to be credible.

#I4CE_Report

Animal farming and environmental transition: managing past investments, rethinking futures ones

All potential environmental transition scenarios rely on a decrease in animal livestock, which as of now is already occurring in France. Support is needed to ensure a just transition with this decrease in livestock. In this study, I4CE explores the risk assets in animal farming, such as production tools which may lose value, and calls for a better management of these assets so as to protect farmers. It is equally important to not create new risk assets through investment subsidy reform.

#I4CE_Report

Reducing meat consumption: public policy still far from sustainability goals

Though the number of livestock animals in France has been decreasing for several decades, meat consumption has only gone up, as documented in a new study by I4CE. At current rates, none of the goals for sustainable meat consumption that are quoted in carbon-neutrality scenarios are attainable for 2050.

#ClimateClub

Agriculture climate club

The agricultural sector is certainly a source of GHG emissions, but it also has a strong mitigation potential that is still under-exploited. It is also one of the sectors most impacted by climate change and must therefore implement a number of changes to adapt to it.

#Press

Euractiv Forum: How to compensate farmers for the carbon that they store?

Beyond debates on livestock numbers, it is necessary to incentivise farmers to adopt carbon storing techniques. How? The European Commission wants to pay farmers for the carbon that they remove, and in order to do so, develop a European Carbon certification system to oversee which projects will be funded. For I4CE’s Adeline Favrel, the European Union can develop an ambitious certification based on different member states’ experience with the matter.

LOCAL AUTHORITIES

#FRANCE

Working out the financial equation

This equation is, as of yet, unsolved, and it will need to be solved soon: the French government is launching a phase of “territorialisation” of environmental planning, and wants to adopt a law on programming public finances in September. I4CE will publish different scenarios on financing local authorities’ climate investments come autumn.

On that note, we salute the government and local authorities’ initiative in generalising “green budgets” on a local scale, using a methodology developed by I4CE and several communities. This methodology is free to use and accessible to all, and helps local elected representatives identify what parts of their budgets contribute to, or delay, the environmental transition.

#I4CE_Report

Local authorities: a need for carbon neutrality investments and engineering

I4CE has closely examined both the investments and human resources that French local authorities have at hand to concretely begin the green energy transition. Mobility, railroads, public transport, energy refurbishment of public buildings, energy efficiency of public lighting and urban heat networks… In total, local authorities should double their investments in environmental transition every year from now until 2030, going from 5.5 to 12 billion euros in investments.

#I4CE_Report

Climate: how French local authorities fund their investment

French local authorities will need to double their investments for energy transition, but will they be able to? In this study, Marion Fetet and François Thomazeau of I4CE decode how communities fund their investments, and the uncertainties that weigh on their different levels of financing: self-financing, government endowments and grants, loans.

#I4CE_Report

Framework for climate budget assessment for cities

The first step to creating a budget for energy transition and organising community funds for environmental goals is understanding what parts of a community’s budget contributes to, or hinders, energy transition. This is why for the past several years, I4CE has developed and shared a framework for climate budget assessment for cities, free of charge, which has been called the “Green Budget”. All resources created by I4CE (methodologies, webinars, FAQ) are available on this page.

ADAPTATION

#FRANCE

The end of a taboo

The first is the energy-climate planning law, in which I4CE recommends the inclusion of the Trajectoire de réchauffement de référence pour l'adaptation au changement climatique (TRACC), or the Reference warming trajectory for adaptation to climate change. Giving this course, announced by Minister Béchu during the major conference on adaptation organised by I4CE and France Stratégie, a normative value is the best way to ensure that we stop investing without knowing whether climate change has been taken into account. I4CE has shown that this is the case, every year, for over €50 billion of public investment.

The second opportunity is next year's finance bill. I4CE's initial assessment of public funding requirements- 2.3 billion euros per year-is now the benchmark. But this is only the first step in the adaptation process. I4CE is currently carrying out a more exhaustive assessment of financing requirements, to enable public policy-makers to anticipate these needs and thus lend credibility to French adaptation policy.

#I4CE_Report

Buildings confronted with new heat waves: invest today to reduce fees tomorrow

Over 35°C in exam halls during the baccalaureate, inhabitants suffered from their residences overheating… Summer 2022 has once again shown that our buildings aren’t adapted for the new heat waves. And yet every year, tens of billions of euros are invested in construction and renovation projects that don’t always take climate change into account. In this study, I4CE proposes immediate action on three levers to kick-start the process of adapting our buildings, and three more structural changes, including changes to thermal regulations.

#I4CE_Report

Putting adaptation to the impacts of climate change on the agenda between local authorities and the government

While local authorities have important levers for environmental adaptation, they will only be able to mobilise them if certain conditions are met at the national level: the entire effort cannot rest on their initiative alone. This is what I4CE‘s Climate Report shows. There is therefore an urgent need for a discussion on adaptation between the government and local authorities, and for the government to specify how it intends to encourage local authorities to speed up the adaptation of their territory.

#I4CEvent

Adapting to climate change on a regional scale

France Stratégie and I4CE organised a conference early this year to take stock on the ambitions of public adaptation policies and their necessary ramp-up in power. I4CE presented their latest work and several political leaders spoke up, including Christophe Béchu, Minister for Ecological Transition and Cohesion of the Territories. I4CE invites you to watch the replay of the event.

STATE FINANCING

#FRANCE

€7 billion more for the climate

We are pleased to have contributed to this momentum. And we will continue to do so, because although the increase in the budget for the transition is unprecedented, as the French government states, it will probably not be enough after 2024. That's why the government needs to plan its climate funding over the long term. The idea of a multi-year trajectory, which I4CE has been advocating for several years, now enjoys a broad consensus. It has also been announced by the Prime Minister, without, however, any further details on its implementation.

All these announcements will have to be reflected, after the summer, in the French public finance programming law and the 2024 finance bill. During this budgetary marathon, we will also need to be vigilant about the effectiveness of public aid and its ability to help the middle and lower classes through the green energy transition. With an extra €7 billion for the climate, the government is making a commitment to efficiency and solidarity.

#I4CE_Report

Landscape of climate finance in France

In the 2022 edition of our Landscape of climate investments in France, you will find our latest figures on the investments made by public and private players in favour of the energy transition… as well as on investments in fossil fuels. In addition to the overall figures, which show an €18 billion increase in investment in the transition, we invite you to delve into our sector-by-sector analyses: housing, mobility and low-carbon energy production. And to discover our assessment of investment needs between now and 2030 according to different scenarios, more or less frugal, more or less technological.

#I4CExpertViewPoint

How does the government plan to finance the increase in its public spending on climate action?

To finance the increase in public spending for the climate, the government seems to favour budget savings, and particularly cutting spending that is unfavourable to the climate, the annual cost of which I4CE estimates is between 7 and 20 billion euros. In this article, I4CE‘s Damien Demailly reviews the savings options available to the government. Clearly, they are all difficult to implement and some may prove counterproductive.

#I4CE_Report

Investments to decarbonize heavy industry in France: what, how much and when?

The French government has put between 5 and 10 billion euros of public funds on the table to decarbonise the most polluting industrial sites. But has the scale of the industry’s investment needs been properly gauged? In this study, we analysed the investment needs of four heavy industry sectors. The results show that requirements vary by a factor of 4 depending on the decarbonisation scenario adopted! Hence the importance of planning and agreeing on the industry of the future to avoid over- or under-investing.

#I4CE_Event

Towards multiannual programming of public finances for the climate

“The Assembly votes on the budget within an annual framework, that of the financial year, and it is becoming clear that this framework is too narrow.” This is how the President of the French Assemblée nationale introduced the conference organised by I4CE and ADEME at the Hotel de Lassay, to debate the multiannual programming of public finances for the climate. The conference was attended by around a hundred of French MPs and senators, cabinet members, senior civil servants and other civilians. We invite you to watch the replay of the event and discover the interviews with some of the speakers.

OUR GOVERNANCE

Renewing the board of Chair members

I4CE has also begun to bring qualified individuals onto its Board of Directors. Stephane Hallegatte, Senior Advisor on Climate Change at the World Bank, and Morgan Després, Executive Director in charge of International Climate Finance and Economics at the European Climate Foundation, have joined our board. Their experience will enable the Institute to pursue its development abroad and continue to push the boundaries of economic expertise on the environmental transition.

1. Jean Pisani-Ferry – Qualified person – Chair of the board members – Economist, Professor in Sciences Po, Paris / EUI, Florence / Bruegel, Brussels / PIIE, Washington DC.

2. Nathalie Tubiana – Secretary – Director of finance and sustainable policy at the Caisse des Dépôts Group.

3. Jean-Michel Beacco – Treasurer – Managing Director Institut Louis Bachelier (ILB), Associate Professor at the Paris-Dauphine Université.

4. Jean Boissinot – Chair member – Deputy director financial stability, Head of network of Central Banks and Supervisors for Greening the Financial System (NGFS’) Secretariat, Banque de France.

5. Mathilde Bord-Laurans – Chair member – Head of Climate Division at the Agence française de développement (AFD).

6. Patrick Jolivet – Chair member – Director of Socio-Economic Studies, ADEME.

7. Joel Prohin – Chair member – Head of Fixed Income Asset Management – Caisse des Dépôts Group.

8. Morgan Després – Qualified person – Executive Director International Finance, Economy & Nature Programmes, European Climate Foundation (ECF).

9. Stéphane Hallegatte – Qualified person – Senior Climate change Advisor, the World bank.

BUDGET & PARTNERS

I4CE bears sole responsibility for its publications

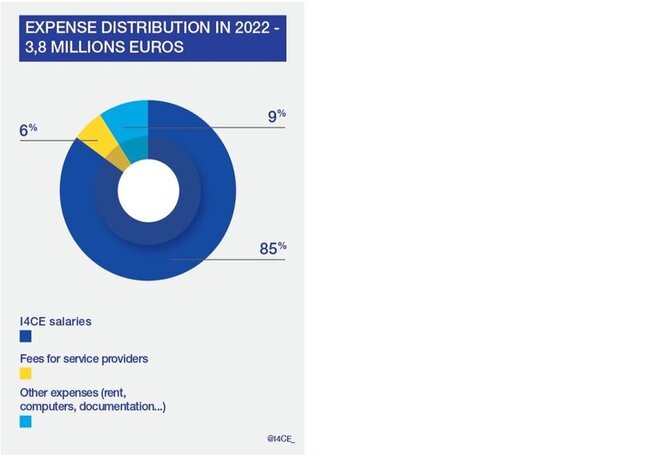

What is this money used for? Primarily, these funds are used to employ the experts that work for I4CE and the support staff that assist them on a daily basis: administration, communication and management. Unlike other comparable institutes or think tanks, I4CE has chosen to produce its studies with experts who are employed directly by the Institute and are developing their skills within the organisation. This approach eliminates the need to outsource experts who are volunteers, paid on a per-assignment basis or having working groups that bring together experts from other organisations.

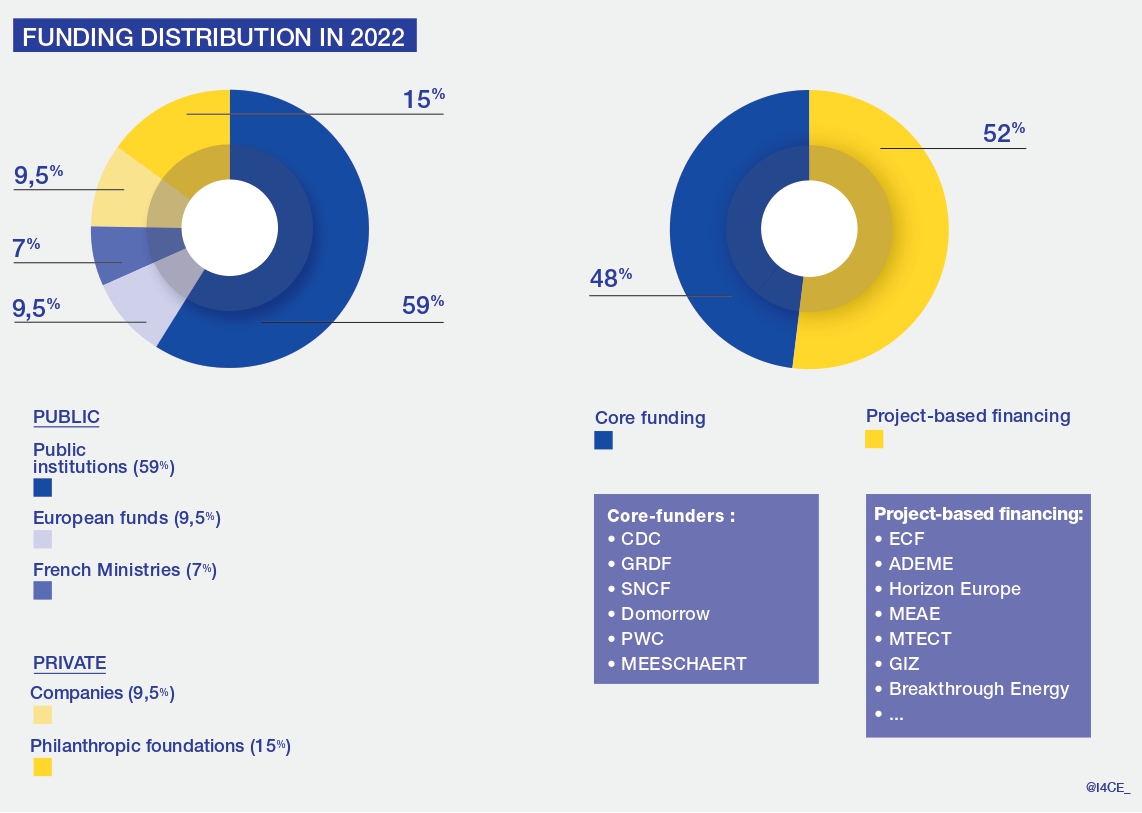

How is I4CE funded? First of all, it is important to note that the Institute’s funders do not define our work program. It is the I4CE team that programs its activities, with the main orientations given by its Board of Directors, and that solicits the support of funders. I4CE is solely responsible for its publications. No funder validates its publications. It is very rare that I4CE responds to calls for tenders, and only when the commissioned studies are in line with the Institute’s work priorities.

Nearly 50% of I4CE‘s funding comes from core-funders, who support I4CE‘s work as a whole rather than individual projects. Initially, the core-funders and founders of I4CE were the Caisse des Dépôts and the Agence Française de Développement. In 2016, I4CE welcomed the addition of the Caisse de Dépôt et de Gestion du Maroc and more recently they have been joined by GRDF and the asset manager Meeschaert.

In addition to this core funding, I4CE benefits from project-based funding, which is targeted on specific projects. Many of the project-based funders have been collaborating with I4CE for many years. As a result, the institute gains visibility on its funding and is able to build a relationship of trust with its funders. However, project funders do not define the I4CE projects. The Institute conceives projects of general interest and then approaches its funders for support. I4CE rarely responds to tenders and if it does, it is only when the studies commissioned are aligned with the Institute’s work projects.

The majority of the project-based funding comes from public institutions: ADEME, Ministry of Ecology, local authorities, European research programs, French National Research Agency. The rest comes from private institutions: philanthropic foundations (European Climate Foundation, Carasso Foundation) and private companies, mainly in the form of subscriptions to I4CE‘s Agriculture and Forestry Clubs.

CARBON FOOTPRINT

I4CE commits to carbon neutrality

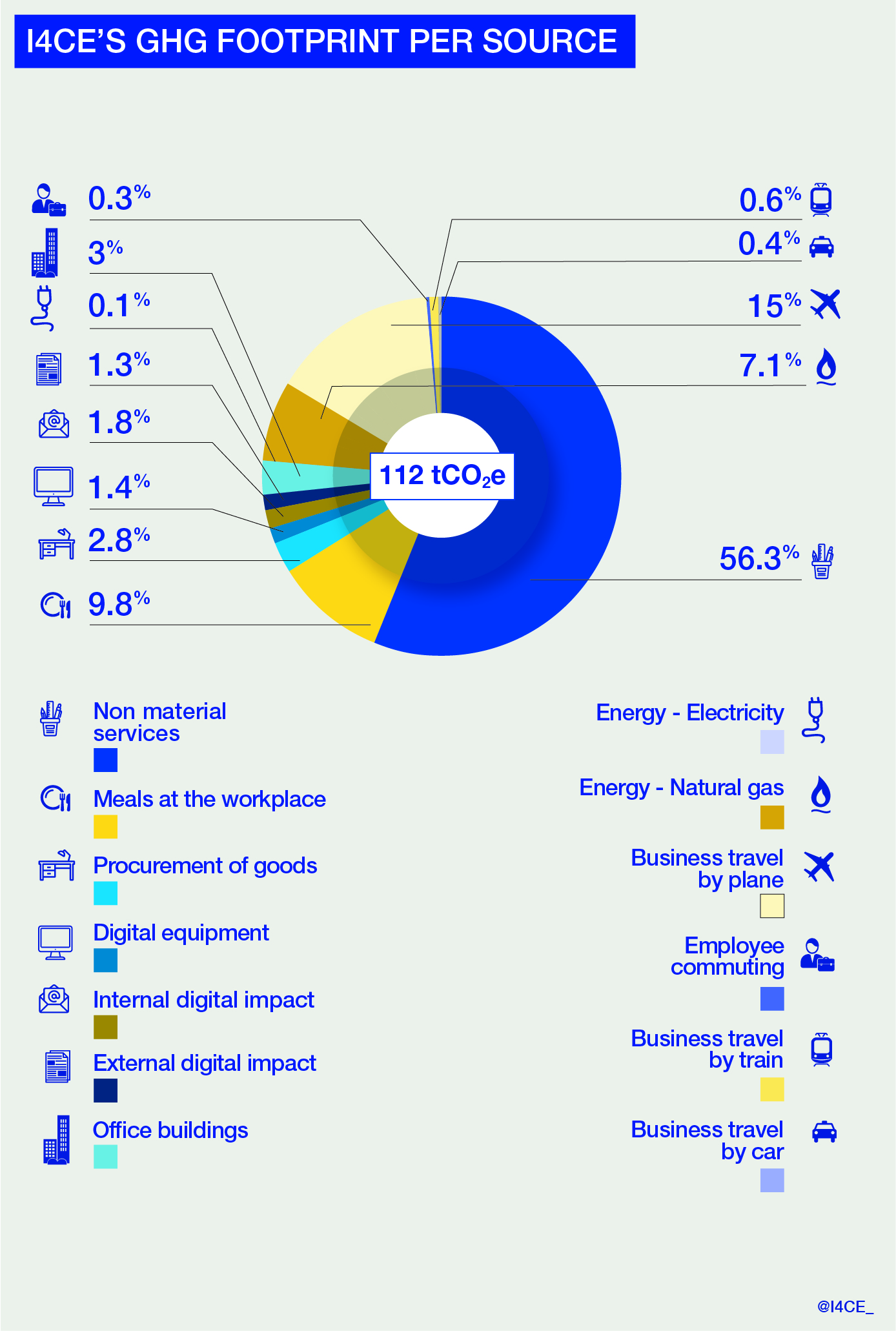

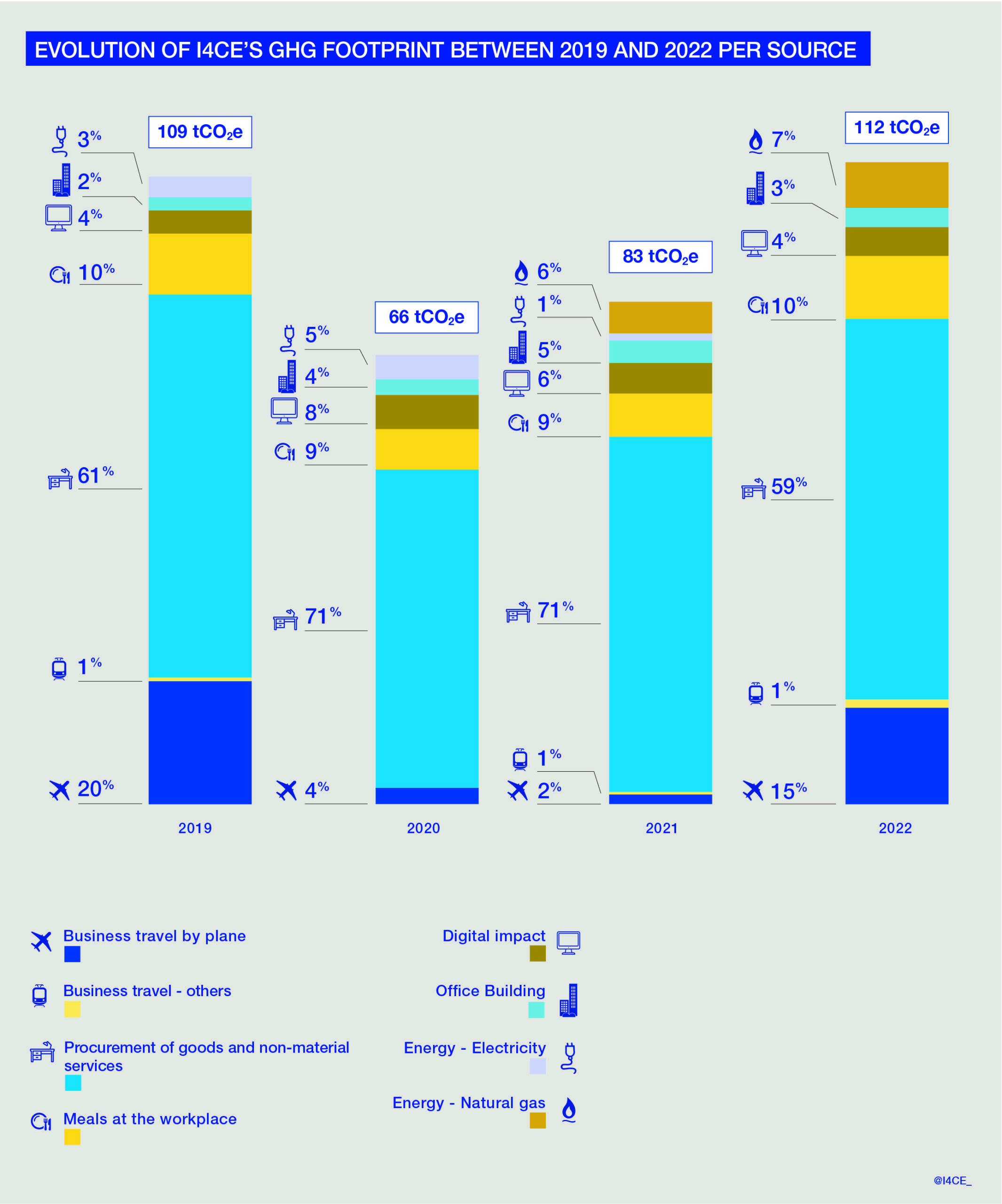

However, our emissions are considerable and we must seek to understand the Institute’s footprint beyond the growth of the team, and strengthen our action plan. I4CE now has an international reach, and it is air travel that primarily explains the significant increase in the 2022 footprint. I4CE staff always endeavour to travel by train when the journey is under six hours. However, it is clear that this is insufficient following I4CE’s internationalization, and means that this area requires rethinking.

I4CE identifies and implements ways to limit its footprint: for example, 90% of the team’s daily meals are in line with a flexitarian diet, and all meals provided at internal events are 100% vegetarian, thus limiting the impact of employee meals in our footprint. In addition, a thermostat set at 19°C limits heating-related emissions.

I4CE’s climate action plan

In 2019, I4CE made a commitment to contribute to carbon neutrality. This commitment resulted from a desire to set an example and was taken out of conviction. An internal working group has been set up to carry out an annual GHG footprint of the Institute to assess our impact, thus enabling us to define an action plan to reduce our emissions. All of I4CE‘s actions in this regard are listed below.

OUR TEAM

* left the Institute in 2023